Federal Direct Loans (Subsidized or Unsubsidized) are funds borrowed from the the U.S. Department of Education (DOE) to help eligible students cover the cost of higher education at a four-year college or university, community college, or trade, career, or technical school.

| Item | Description |

|---|---|

|

Entrance Loan Counseling for Subsidized & Unsubsidized Loans |

A module overview of how the Federal Direct Loan process works - What a Loan is, how interest works, options for repayment, and how to avoid delinquency and default. |

|

Master Promissory Note (MPN) for Subsidized & Unsubsidized Loans |

A legal document in which a student promises to repay their Loans and any accrued interest and fees to the U.S. Department of Education. It also explains the terms and conditions of the Loans. |

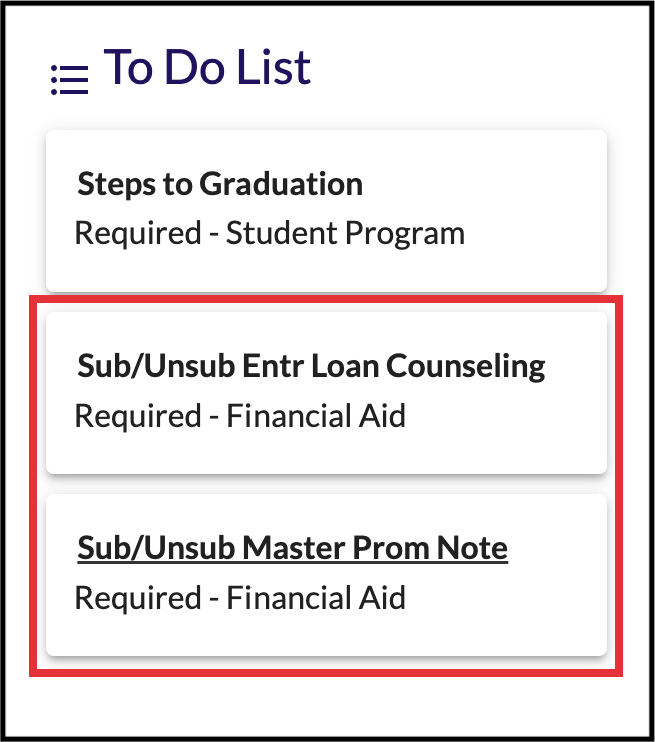

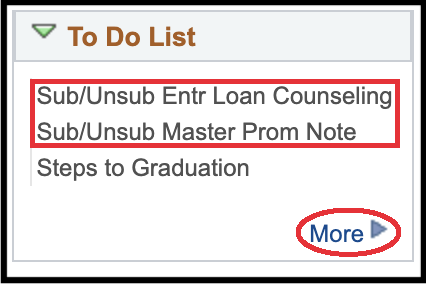

Manually accepted Loans will trigger additional items to complete on a student’s To Do List located in their SF State Gateway or Student Center. For Federal Direct Loans, these are the items students must complete as they will appear on there.

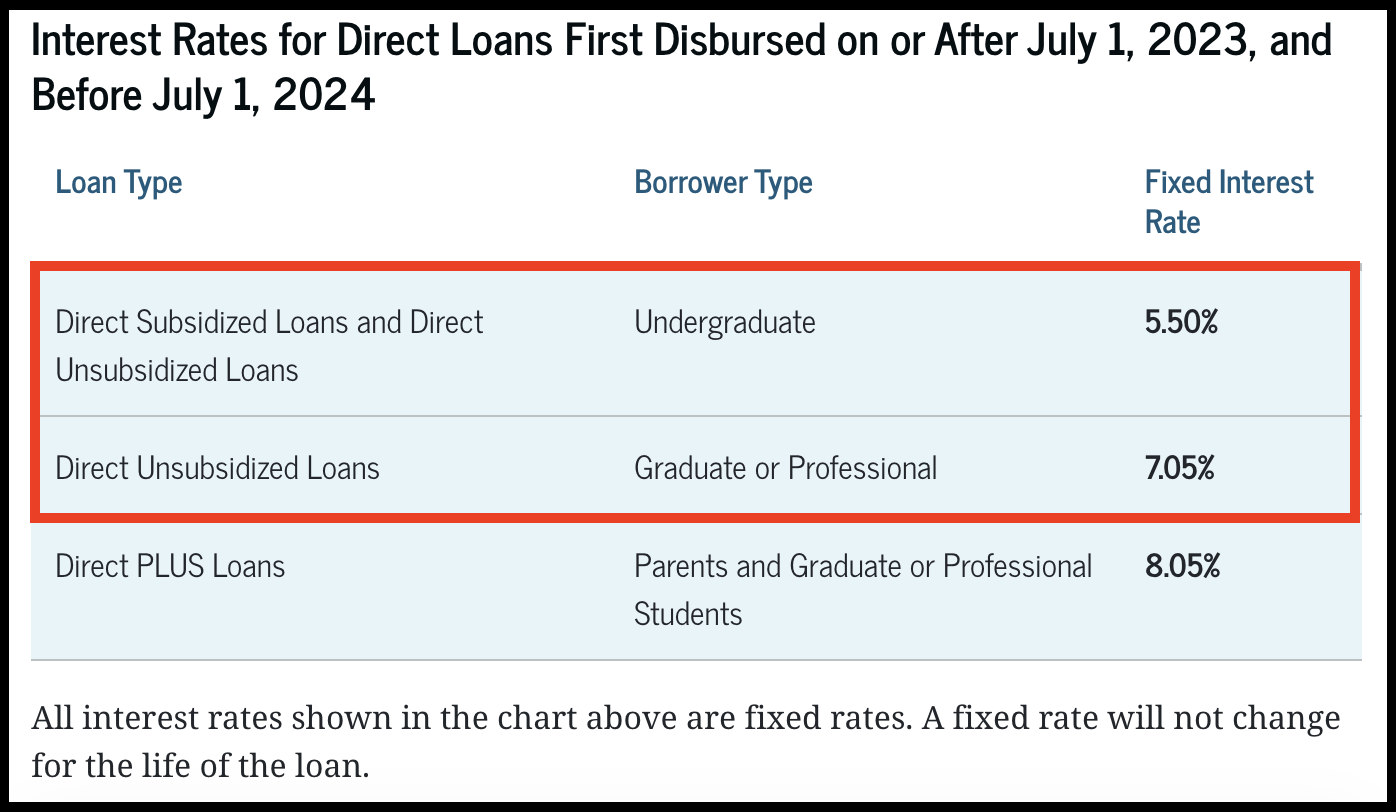

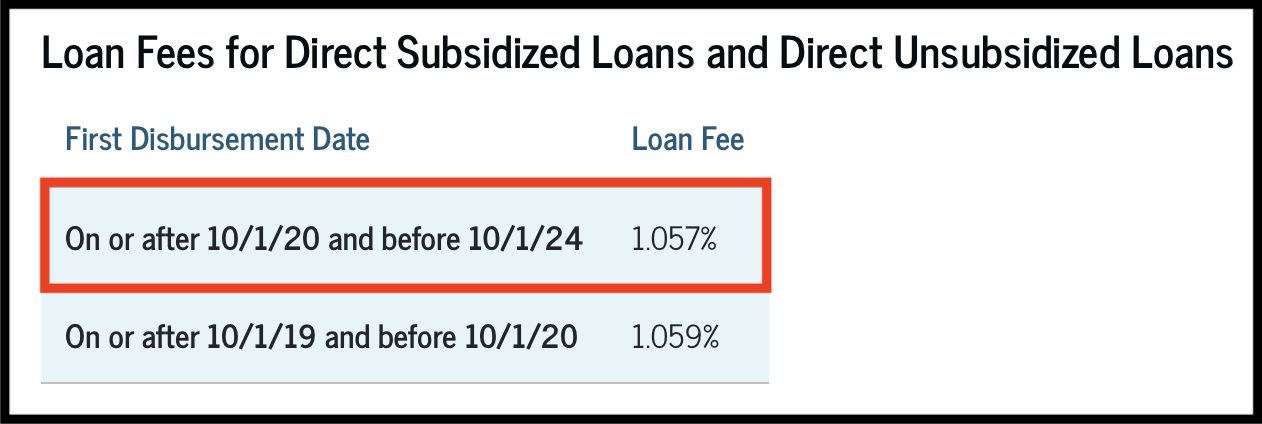

As confirmed by Federal Student Aid (FSA), listed below are the Interest rates and Loan origination fees for the 2023-2024 school year (Fall 2023, Spring 2024, & Summer 2024).

Types of Federal Direct Loans

1.) Direct Subsidized Loans

These type of Loans are funding that the Federal Government will NOT charge a student interest on prior to repayment. The Government pays the interest while the student remains enrolled in school at least HALF-TIME amount (6 units), during the 6-month grace period (Except for loans disbursed between July 1, 2012 and July 1, 2014) and during all eligible periods of deferment.

Subsidized Usage Limit Applies (SULA):

- SULA limits a borrower's eligibility for Direct Subsidized Loans to a period not to exceed 150% of the length of the borrower's educational program.

- Students who have exceeded the 150% limit will lose the interest subsidy on their Direct Subsidized Loans.

- Only "first-time" borrowers on or after July 1, 2013 are subject to the new provision.

- Loan maximums are based on the published length of your program. Please check in with your designated college department regarding the length of your particular program.

- Subsidized Loans accrued from previous academic programs will count toward your SULA eligibility in your present program. SULA calculations do not restart if you start a new program.

Examples of SULA:

- Example #1: A student is enrolled in a four-year Undergraduate program, the maximum period for which they can receive Direct Subsidized Loans is six years (150% of 4 years = 6 years).

- Example #2: A student is enrolled in a two-year Associate degree program or a two year academic certificate program, the maximum period for which you can receive Direct Subsidized Loans is three years (150% of 2 years = 3 years).

NOTE: If a student was previously enrolled in a 4-year or other program and have taken out Subsidized loans, those previous Loans will be part of the SULA calculation.

2.) Direct Unsubsidized Loans

These type of Loans are funding that the Federal Government will charge a student interest on from the day the funds are disbursed until the Loan is repaid in full. Interest is accrued daily for these Loans.

- The principal loan balance payments are deferred, if you are enrolled in a college or university at least a half-time. However, you must pay interest on the Unsubsidized loan while you are in school and during any grace or in-school deferment periods.

- You may choose to have the interest deferred. This will result in the deferred interest being added to the principle loan amount borrowed at the time your repayment begins. This is called capitalization. Having the interest capitalized will mean a higher loan amount owed than originally borrowed.

For more information regarding Federal Direct Loan guidelines, please click on the link provided right below

Additional FAQs for Federal Direct Loan Process

- Accepted the Federal Direct Loan offer on their Student Center

- Complete the Federal Direct Loan Checklist Items as listed at the top of this page

- Be accepted for enrollment in a degree program at SF State (Unclassified graduates and some students enrolled through CPaGE are not eligible).

- Be registered at least HALF-TIME amount: 6 units for Undergraduate, Second Bachelor and Credential students / 4 units for Graduate for Master's degree students.

- Not currently in Default on a Federal Student Loan (Examples: Guaranteed Student Loan (GSL), Perkins Loan, Federal Family Education Loan (FFEL), or Stafford Loans)

- Not owing a repayment on Federal or State Grants.

- Meeting Satisfactory Academic Progress (SAP) for the current semester

- Once our office has received the student's Loan acceptance in their Student Center and completed the Federal Direct Loan checklist items as listed above, we will subsequently process the Loan request and authorize the disbursement of the funds.

- All Federal Direct Loans for the academic year will be disbursed in two equal disbursements: Half for Fall and half for Spring.

- Loans will always disburse towards any charges on a student's account first. If there are any leftover funds after everything is paid off, the Bursar’s Office will issue the student a refund.

- Every student has the right to cancel all or a portion of their Direct Loans or Federal TEACH Grants disbursed to them. To avoid paying the administrative fee with these awards, the student must return the funds to the Bursar's Office within 120 days of the original refund date.

Yes - A student may be able to replace the Federal Work-Study (FWS) award amounts for a Direct Loan increase, if a student is awarded FWS and does not plan to use the award for employment. The student must have remaining eligibility for the Loan increase. Otherwise, the Loan amount CANNOT be more than the annual maximum based on the student's class level. Interested students should speak with a Financial Aid Counselor first before requesting this.

If a Dependent student's Parents are ineligible a Parent PLUS Loan, they may be qualified for an increase in with their Unsubsidized Loan award for the year. For more information regarding this process, please check the "Option #3: Additional Unsubsidized Loan" for the link provided right below.

If a student’s remaining period of study is shorter than an academic year, or a student’s academic program is shorter than an academic year, then students may request to be evaluated for a proration of student loans. Students may be eligible for proration of Loans if they are enrolled in more than 12 units during their graduating semester.