Verification is the process used by educational institutions to check the accuracy of a student's financial aid application (FAFSA or CADAA). This process ensures that the student is being awarded the correct type of financial aid based on the submitted documentation. Typical documents required from students or parent(s) for verification are:

- Financial aid forms

- Tax documents - Based on financial aid application year

- Third party statement(s)

- Student/parent signed statements

Content Breakdown

How do I complete my Verification items?

Students are expected to complete their verification items online through their SF State Gateway. For more information regarding this process, please feel free to review the guide provided right below.

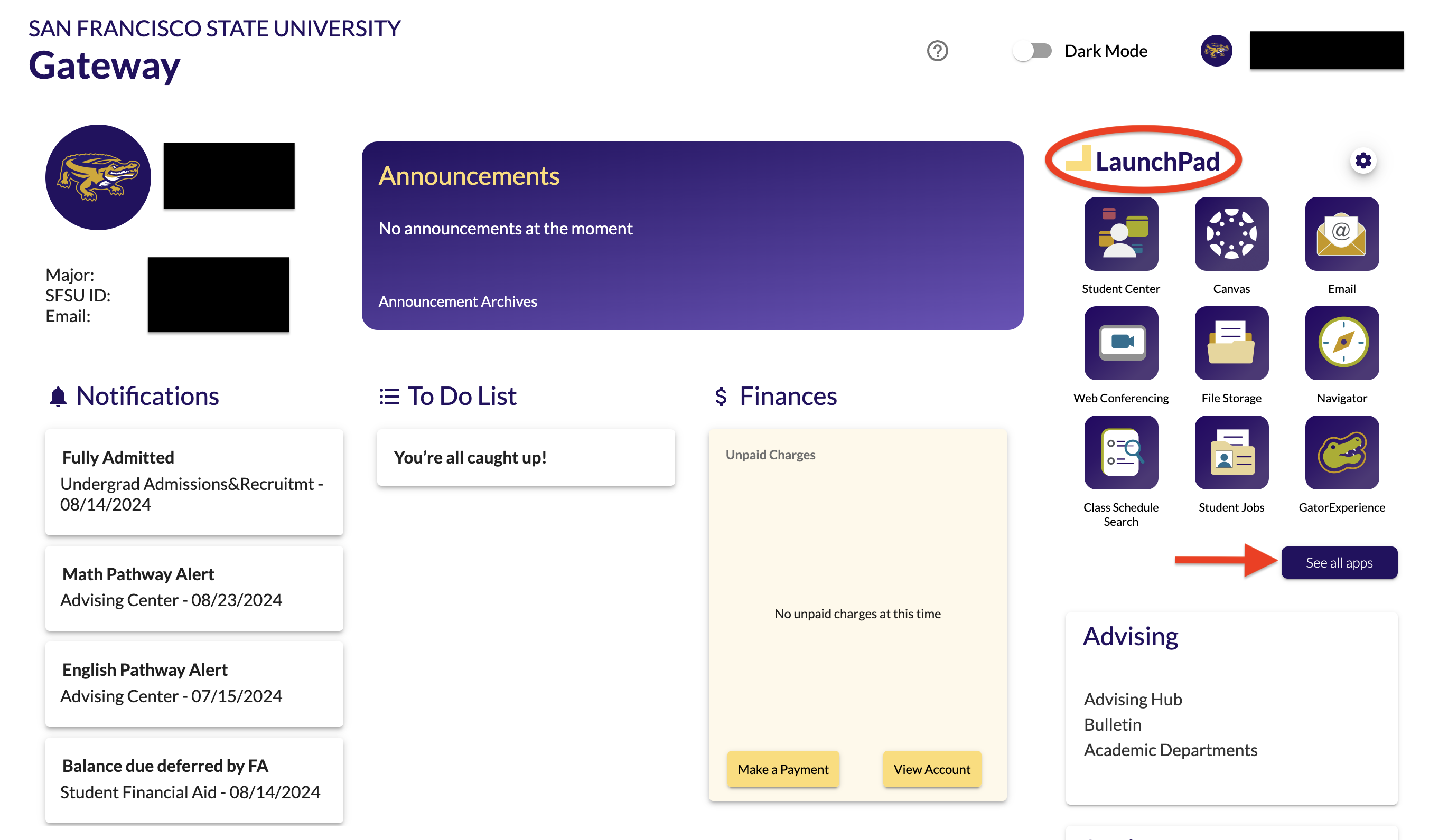

1.) Log on to your SF State Gateway with your SF State Login

2.) Find the Launchpad section of your Gateway and click on "See all apps"

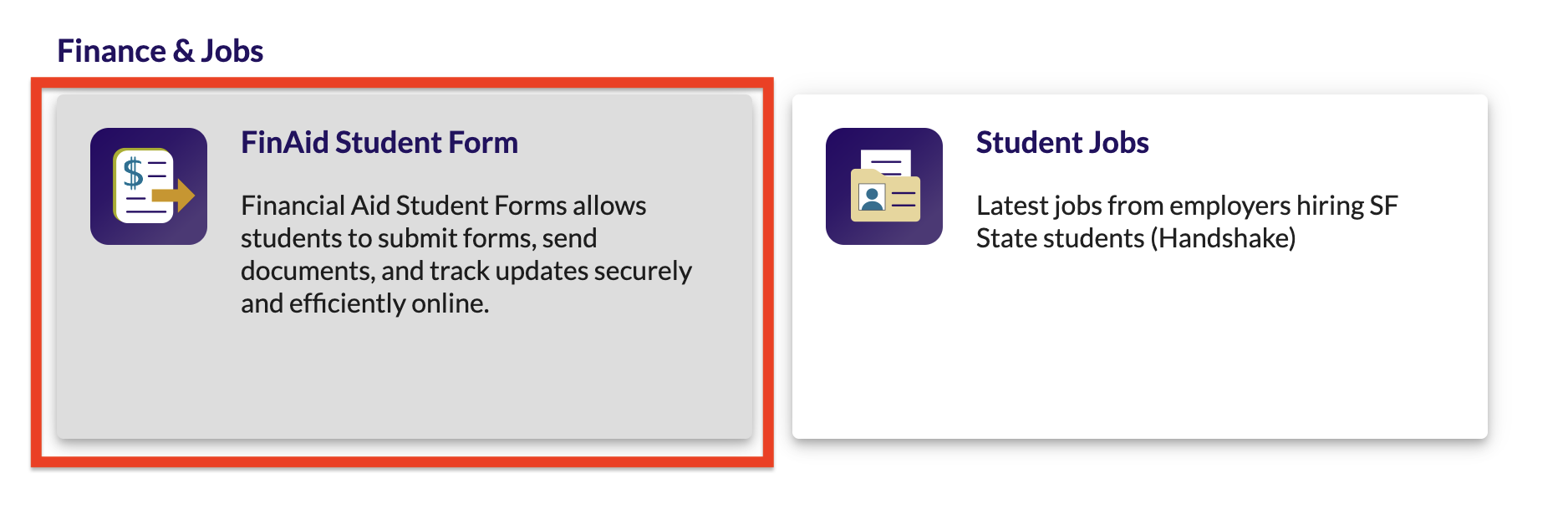

3.) Scroll to the Finance & Jobs section and click on the "FinAid Student Form" button to access the online submission link

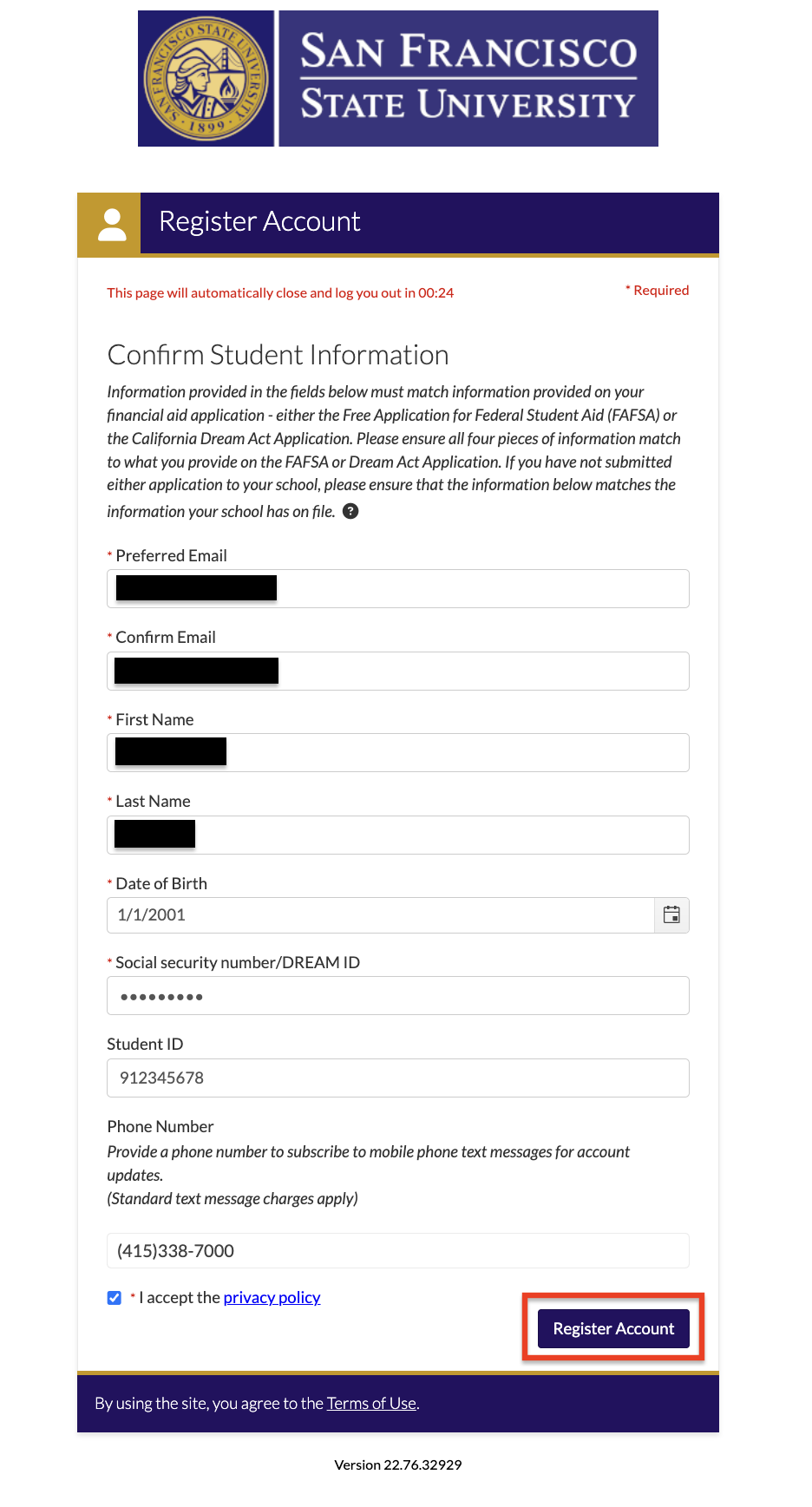

4.) After clicking the link, it will prompt you to create an account if you haven't already. Answer the personal questions listed and click on the "Register" button to finish the account creation process

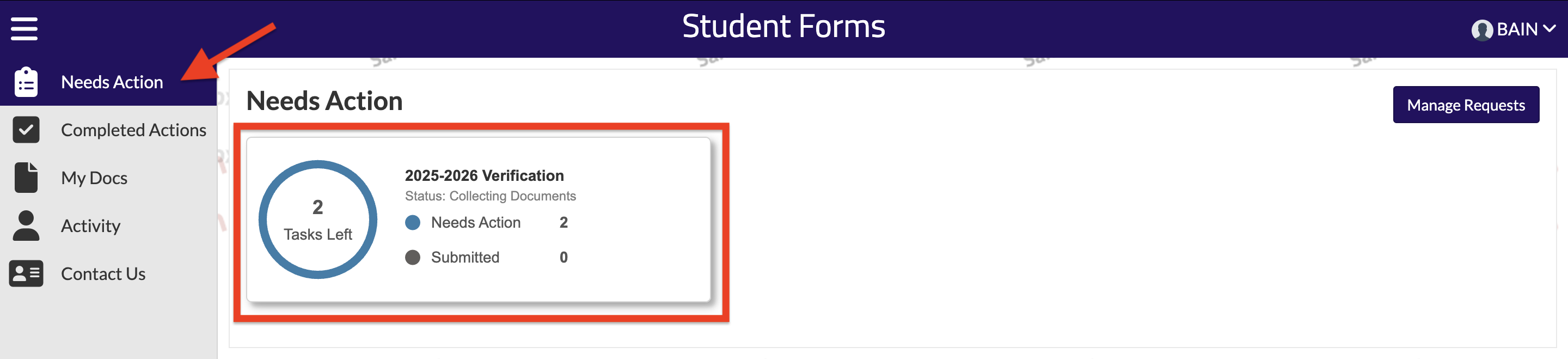

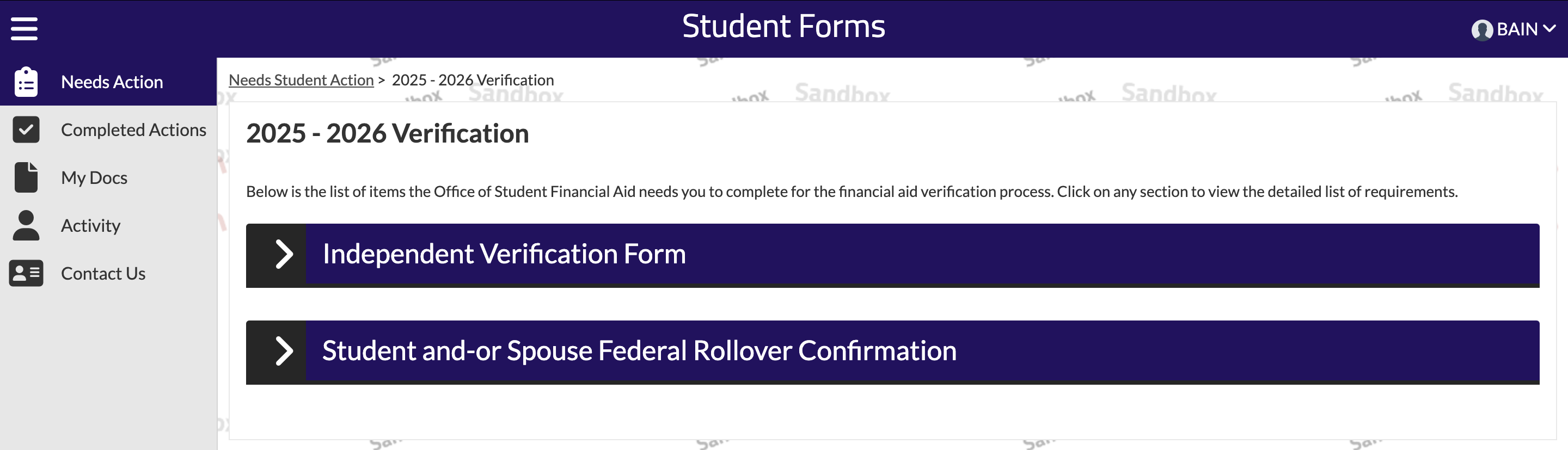

5.) Once logged in, if you have any forms that need to be completed, it will be listed on the "Needs Action" section. Click on the link provided once you are ready to view and complete your forms

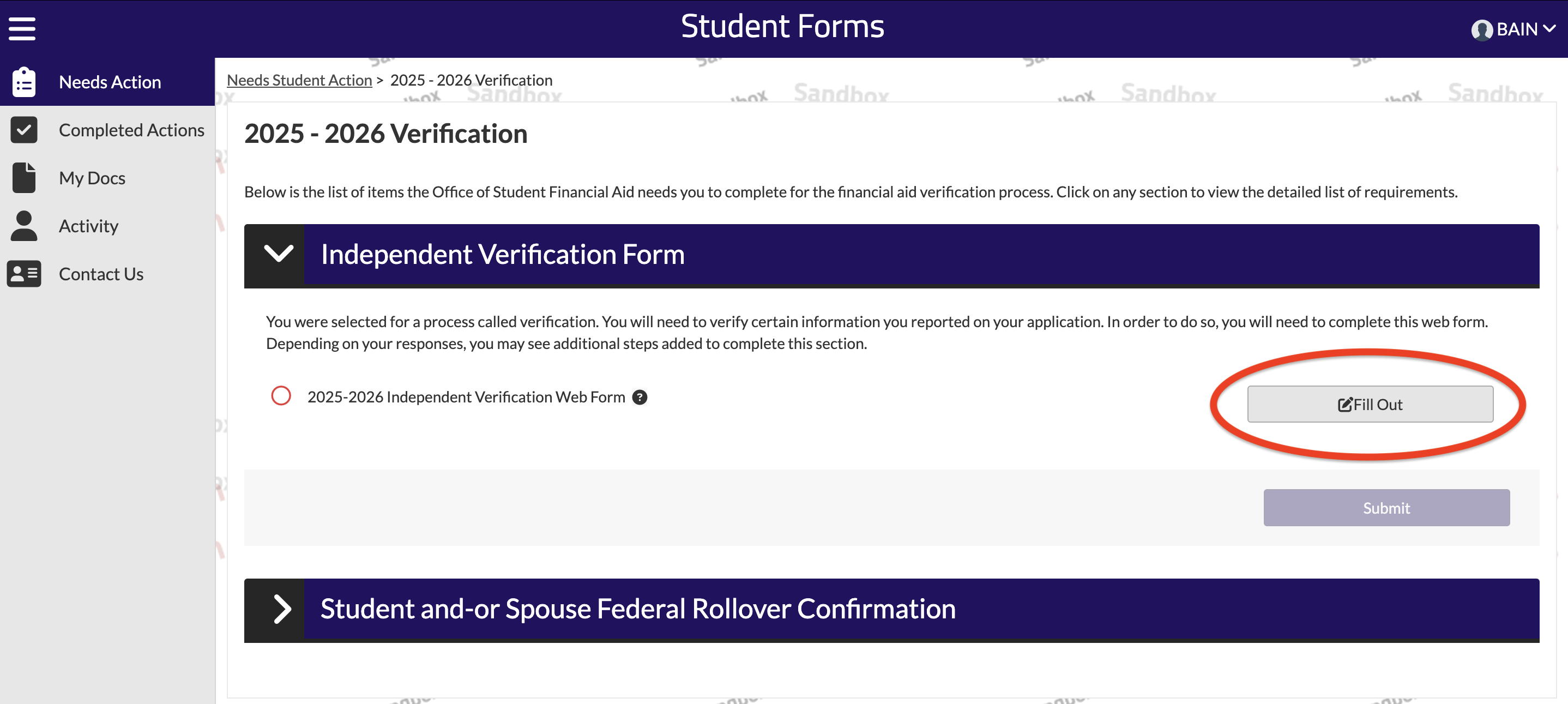

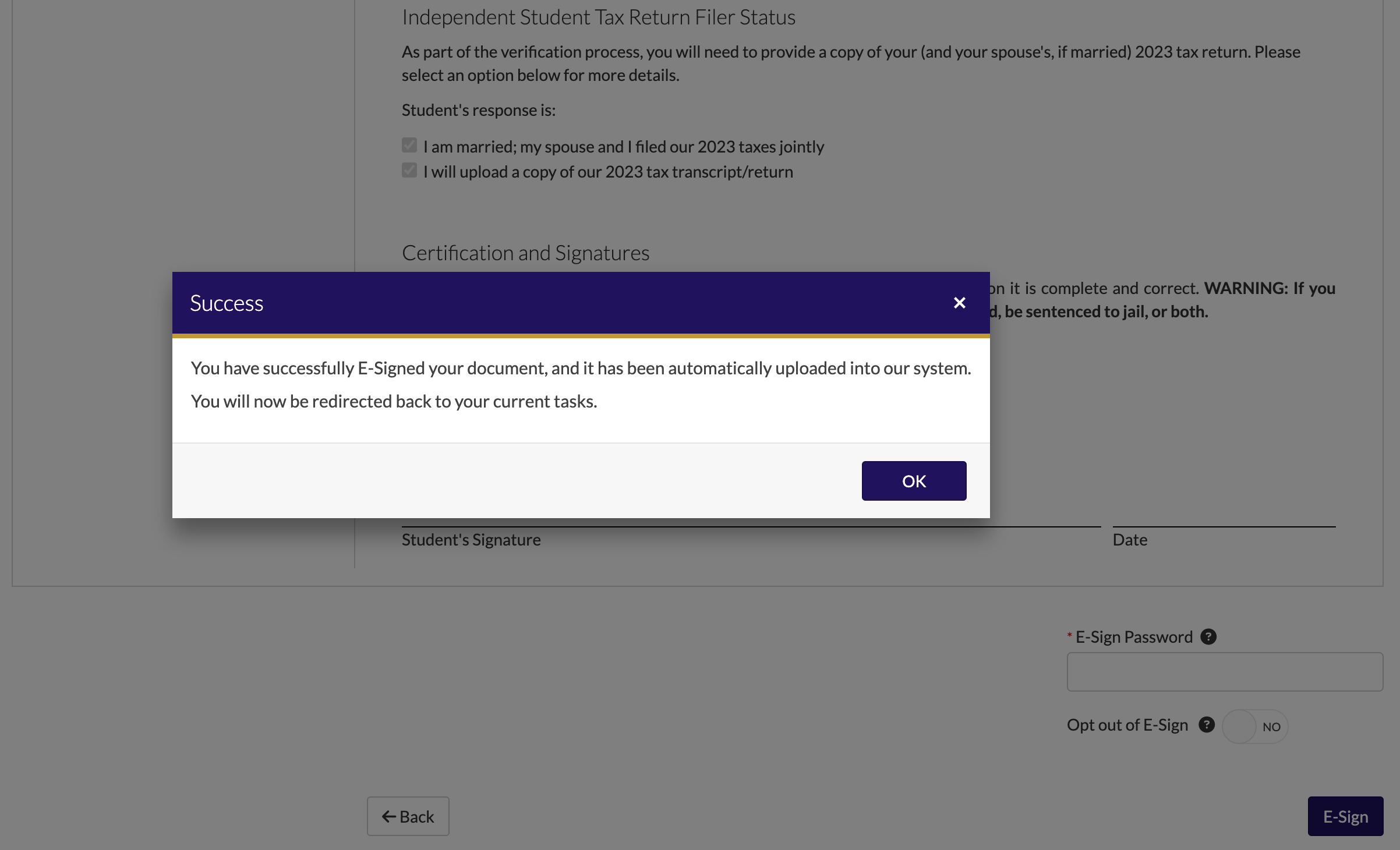

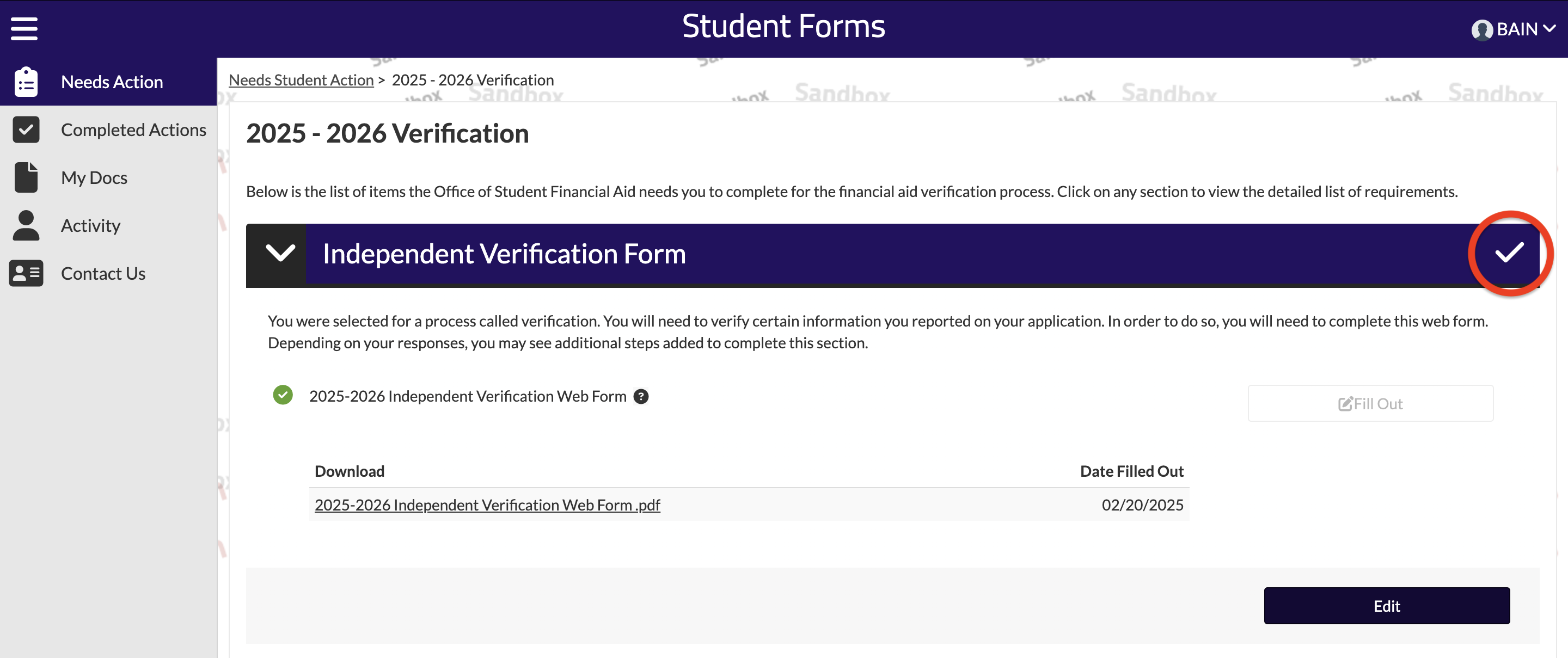

6.) Click on the form that you want to complete and select the "Fill Out" button to begin. Answer all the sections needed on the form and provide your signature at the end. You should receive a confirmation that the signature was successfully accepted before exiting

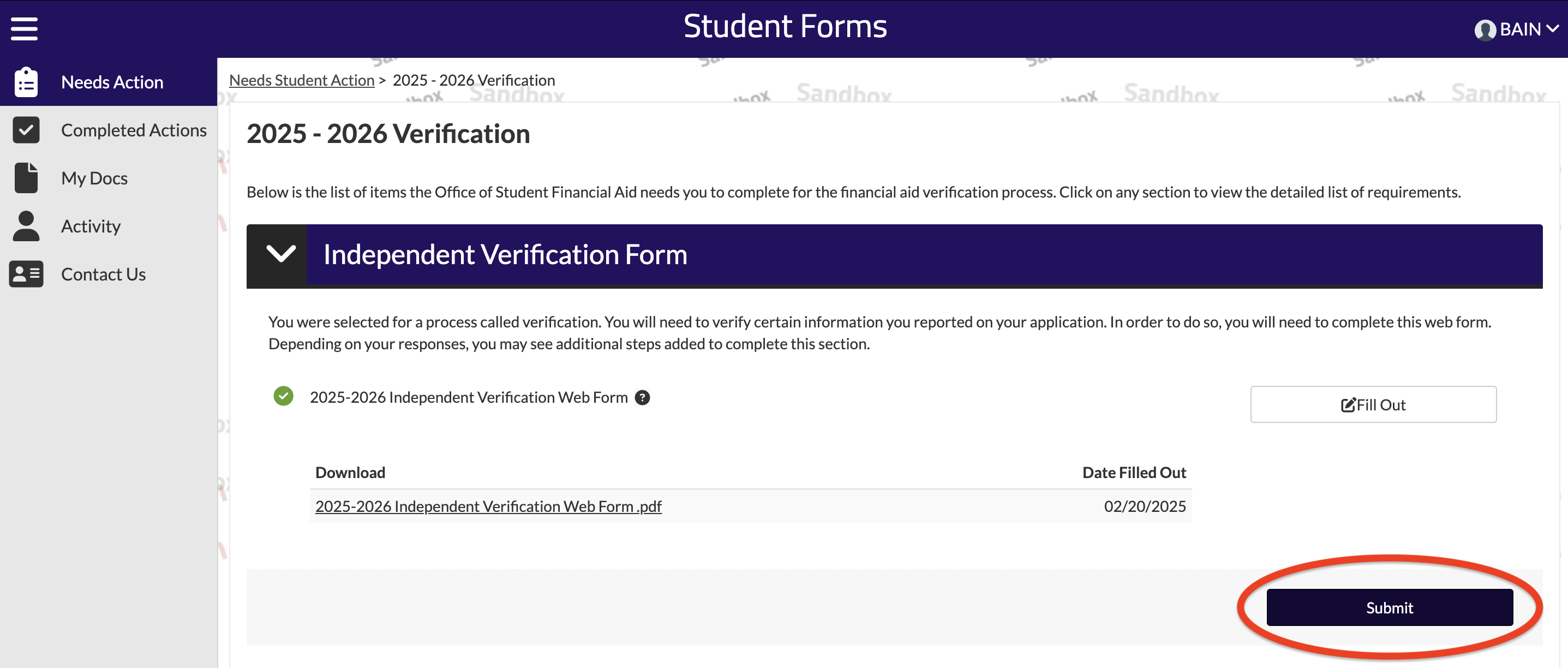

7.) After exiting the form, click on the "Submit" button to complete the submission process.

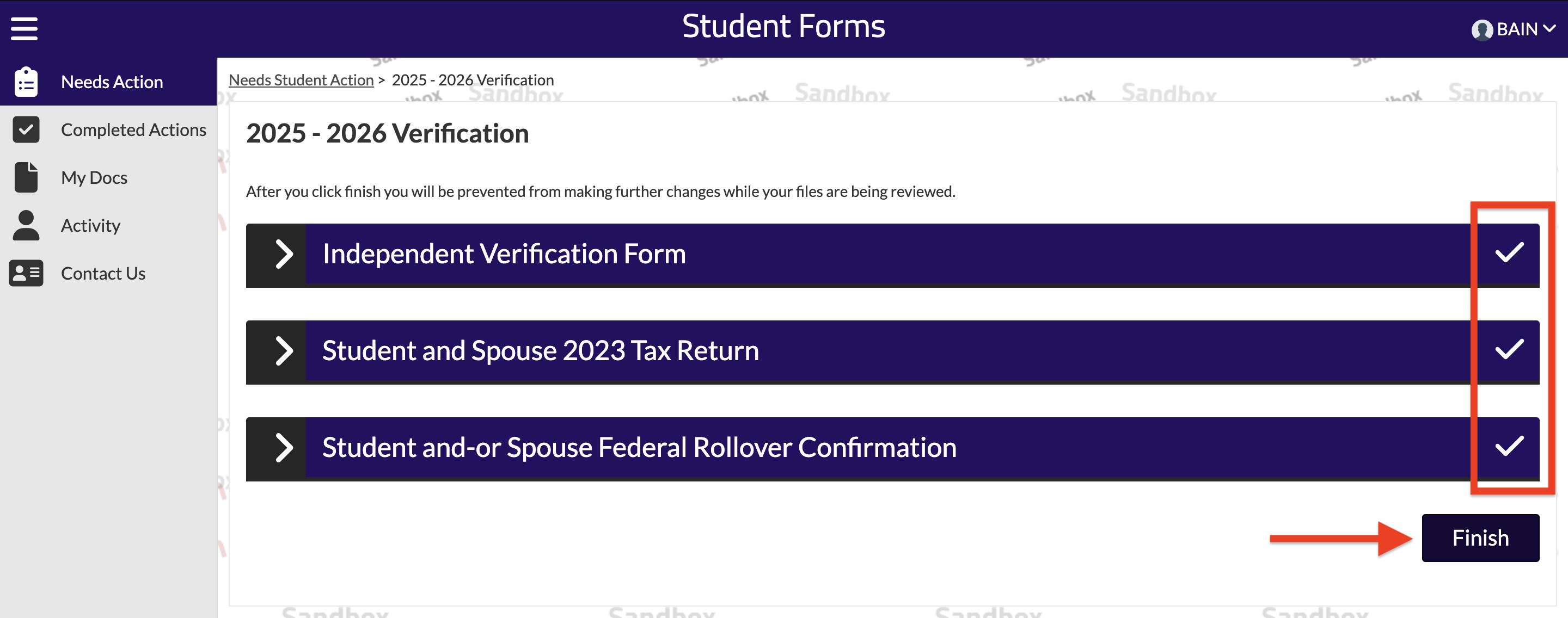

NOTE: A check mark is confirmation that the form you completed was successfully submitted.

8.) Go through all the forms required in your account and make sure that to attach any supporting documents when being prompted to. Once you have completed all your forms, click on "Finish" button to submit all your documents to our office.

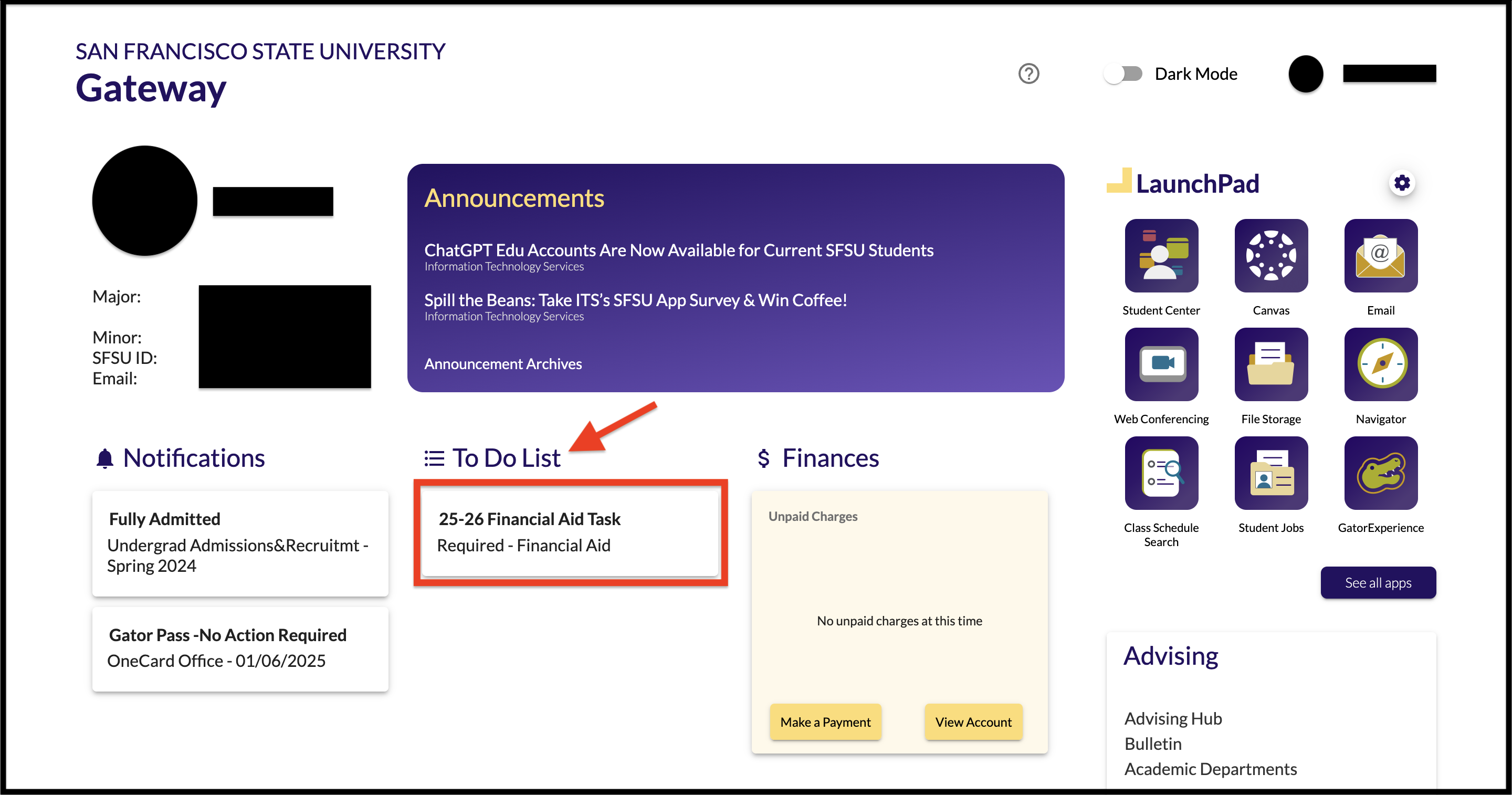

How do I know if I'm selected for Verification?

Students will receive an e-mail from our office in their SF State e-mail regarding financial aid related items on their To Do List.

We highly recommend reviewing every financial aid related item on the To Do List very carefully and contact us if there are any questions. Most of these items will already have an option to complete the form online and include any supporting documentation required (Ex. Tax forms, official third party letters, signed statements, etc.)

What are reasons why I would be selected for Verification?

Students/parents who have conflicting tax filing statuses for the year the financial aid application requires may result in a higher chance of the application being selected for further review. These are the most common tax statues that can result in that scenario:

- Married Filing Separately

- Unmarried Living Together

- Amended Tax Filers

Students/parents who reported that they earned income from a different country will also be likely selected for review. As expected, every foreign country will have their own type of tax documentaiotn. However, the foreign income will have to be translated into U.S. dollars (USD). These are the typical documentation required for foreign tax filers:

- Official tax documentation from the foreign country equivalent to a Form 1040 that confirms how much the student/parent made for the year required

- Official tax documentation from the foreign country equivalent to a Verification of Non-Filing Letter confirming the student/parent did not work for the year required

- Signed statements from student/parent confirming the foreign income amount translated into USD

An individual who was the victim of IRS tax-related identity theft must provide:

- A Tax Return DataBase View (TRDBV) transcript obtained from the IRS, or any other IRS tax transcript(s) that includes all of the income and tax information required to be verified; and

- A statement signed and dated by the tax filer indicating that he or she was a victim of IRS tax-related identity theft and that the IRS is aware of the tax-related identity theft.

To request TRDBV, please contact the IRS Identity Protection Specialized Unit at 1-800-908-4490

What tax documents do I need to submit?

2025-2026 school year (Fall 2025 & Spring 2026) - 2023 tax documents

2024-2025 school year (Fall 2024 & Spring 2025) - 2022 tax documents

For students/parents who are required to submit tax documentation, please review the guide down below:

| Work Status | 2023 Tax Document |

|---|---|

| Employed and required to file taxes | |

| Employed but not required not file taxes |

|

| Not employed and not required to file taxes |

|

| Work Status | 2022 Tax Document |

|---|---|

| Employed and required to file taxes | |

| Employed but not required not file taxes |

|

| Not employed and not required to file taxes |

|

How long will it take to review my documents?

Review Timeframe: 2 to 3 weeks from the date all the documents were received by our office.

All documents submitted to our office are assigned on a weekly basis for Financial Aid Counselors to review. Review timeframe can take anywhere between 2 to 3 weeks from the date all the documents were received in our system.

How students can track whether or not their documents have been completely reviewed is:

- The Financial aid related items on the To Do List have disappeared

- They received an e-mail from our office starting that they have been awarded financial aid for the school year that they are attending

NOTE: We highly recommend staying up to date with your SF State e-mail in case the Financial Aid Counselor assigned to your file may ask for follow-up documentation or clarification for your verification file.