Federal Direct Loans (Subsidized or Unsubsidized) are funds borrowed from the the U.S. Department of Education (DOE) to help eligible students cover the cost of higher education at a four-year college or university, community college, or trade, career, or technical school.

Content Breakdown

Types of Direct Loans

Subsidized Loans are available for Undergraduate students only.

These type of Loans are funding that the U.S. Department Of Education (DOE) will not charge a student interest on prior to repayment. DOE will pay the interest while the student as long as the student are meeting these standards:

- Enrolled in at least half-time amount (6 units - Undergraduate or Credential students / 4 units - Graduate students)

- 6 month grace period after graduating or withdrawing from classes (Except for loans disbursed between July 1, 2012 and July 1, 2014)

- Any other periods accepted for deferment

These type of Loans are funding that DOE will charge a student interest on from the day the funds are disbursed until the Loan is repaid in full. Interest is accrued daily for these Loans.

- The principal loan balance payments are deferred (Delayed), if the student is enrolled in a college or university at least a half-time status. However, students must pay interest with this Loan while they are in school, during any grace periods, or in-school deferment periods.

- Students may choose to have the interest deferred. However, this will result in the deferred interest being added to the principle Loan amount borrowed at the time your repayment begins. This process is called "Loan Capitalization." Having the interest capitalized will mean a higher Loan amount owed than originally borrowed.

Federal Direct Loan Items

Loan Item(s) Processing Timeframe - 2 to 3 weeks after successful completion

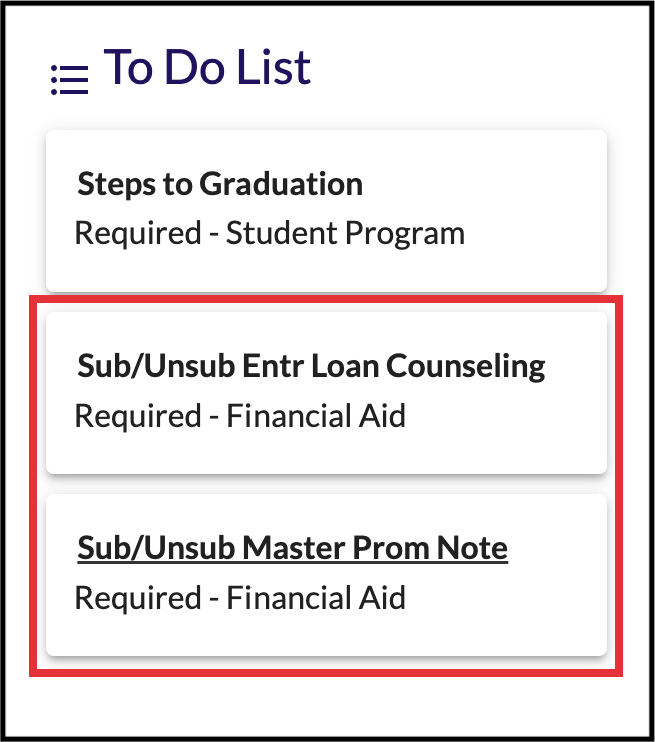

Manually accepted Loans will trigger additional items to complete on a student’s To Do List located in their SF State Gateway. For Federal Direct Loans, these are the items students must complete as they will appear on there.

| Item | Description |

|---|---|

| Entrance Loan Counseling for Subsidized & Unsubsidized Loans | A module overview of how the Federal Direct Loan process works - What a Loan is, how interest works, options for repayment, and how to avoid delinquency and default. |

| Master Promissory Note (MPN) for Subsidized & Unsubsidized Loans | A legal document in which a student promises to repay their Loans and any accrued interest and fees to the U.S. Department of Education. It also explains the terms and conditions of the Loans. |

NOTE: Feel free to use the demo links provided right below in order to get a preview of how the Loan Counseling and MPN signing will go.

Federal Direct Loan Interest Rates

Interest rates and Loan origination fees are for the 2024-2025 school year (Fall 2024, Spring 2025, & Summer 2025).

| Loan Type | Borrower Type | Fixed Interest Rate |

|---|---|---|

| Direct Subsidized Loans and Direct Unsubsidized Loans | Undergraduate | 6.39% |

| Direct Unsubsidized Loans | Graduate or Professional | 7.94% |

| First disbursement Date | Loan Fee |

|---|---|

| On or after 10/1/20 and before 10/1/25 | 1.057% |

| On or after 10/1/19 and before 10/1/20 | 1.059% |

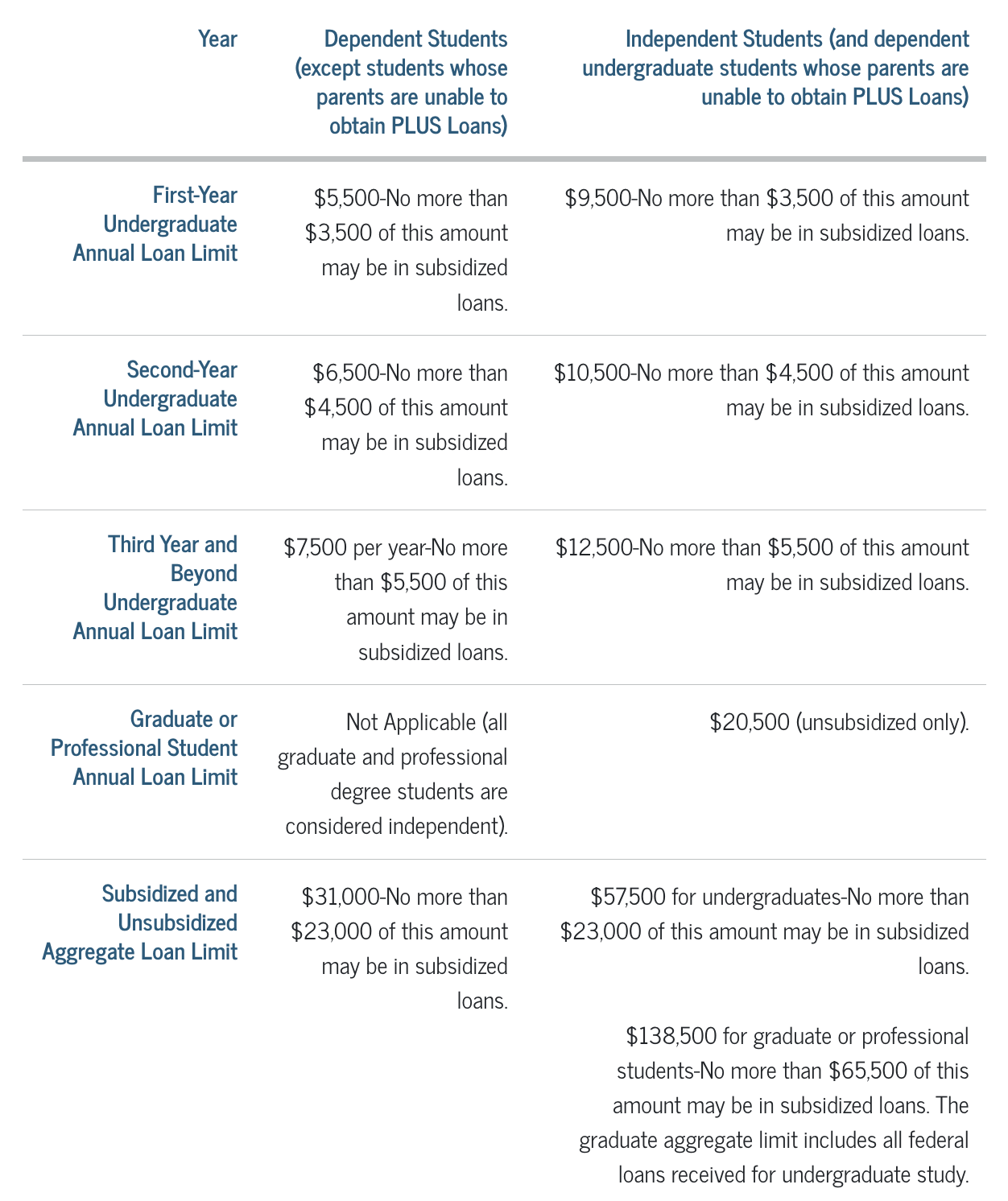

Federal Direct Loan Limits

Federal Direct Loans are capped at a maximum amount every school based on these criteria:

- Grade level

- Dependency status

- Overall Loan history

Frequently Asked Questions (FAQS) about Federal Direct Loans

- Accepted Federal Direct Loan offer

- Successfully completed the Federal Direct Loan items

- Admitted for enrollment in a degree program at SF State. Unclassified graduates and some students enrolled through College of Professional & Global Education (CPAGE) are not eligible

- Be registered at least half-time amount: 6 units for Undergraduate or Credential students / 4 units for Graduate students

- Not currently in Default status on a Federal Student Loan (Examples: Guaranteed Student Loan (GSL), Perkins Loan, Federal Family Education Loan (FFEL), or Stafford Loans)

- Not owing a repayment on Federal or State Grants.

- Meeting Satisfactory Academic Progress (SAP) for the current semester

NO. As mentioned above, there are annual limits to how much a student can receive in Federal Direct Loans. However, students who did not accept their full Loan amount may be able to accept the remainder for their Loan by completing the form listed right below.

NOTE: Form is for the 2024-2025 school year (Fall 2024, Spring 2025, & Summer 2025)

For more information regarding the financial aid disbursement process, please click on the link provided right below.

NOTE: Every student has the right to cancel all or a portion of their Direct Loans or Federal TEACH Grants disbursed to them. To avoid paying the administrative fee with these awards, the student must return the funds to the Bursar's Office within 120 days of the original refund date.

If a Dependent student's Parents are ineligible a Parent PLUS Loan, they may be qualified for an increase in with their Unsubsidized Loan award for the year. For more information regarding this process, please check the "Option #3: Additional Unsubsidized Loan" for the link provided right below.

YES. A student may be able to replace the Federal Work-Study (FWS) award amounts for a Federal Direct Loan increase, if a student is awarded FWS and does not plan to use the award for employment. However, the Loan increase must be within the student's allowed annual limit as mentioned earlier in this page.