Parent PLUS Loans are borrowed funding that parent(s) of dependent Undergraduate students (23 or younger) can use to help pay for college or career school as provided by the U.S. Department Of Education (DOE). These Loans can help pay for education expenses not covered by other financial aid.

Start Your Support!

How do I apply for a Parent PLUS Loan?

Awarding Timeframe - 2 to 3 weeks after successful application submission

For a step-by-step guide on how to apply for a Parent PLUS Loan, please click on the guide provided right below.

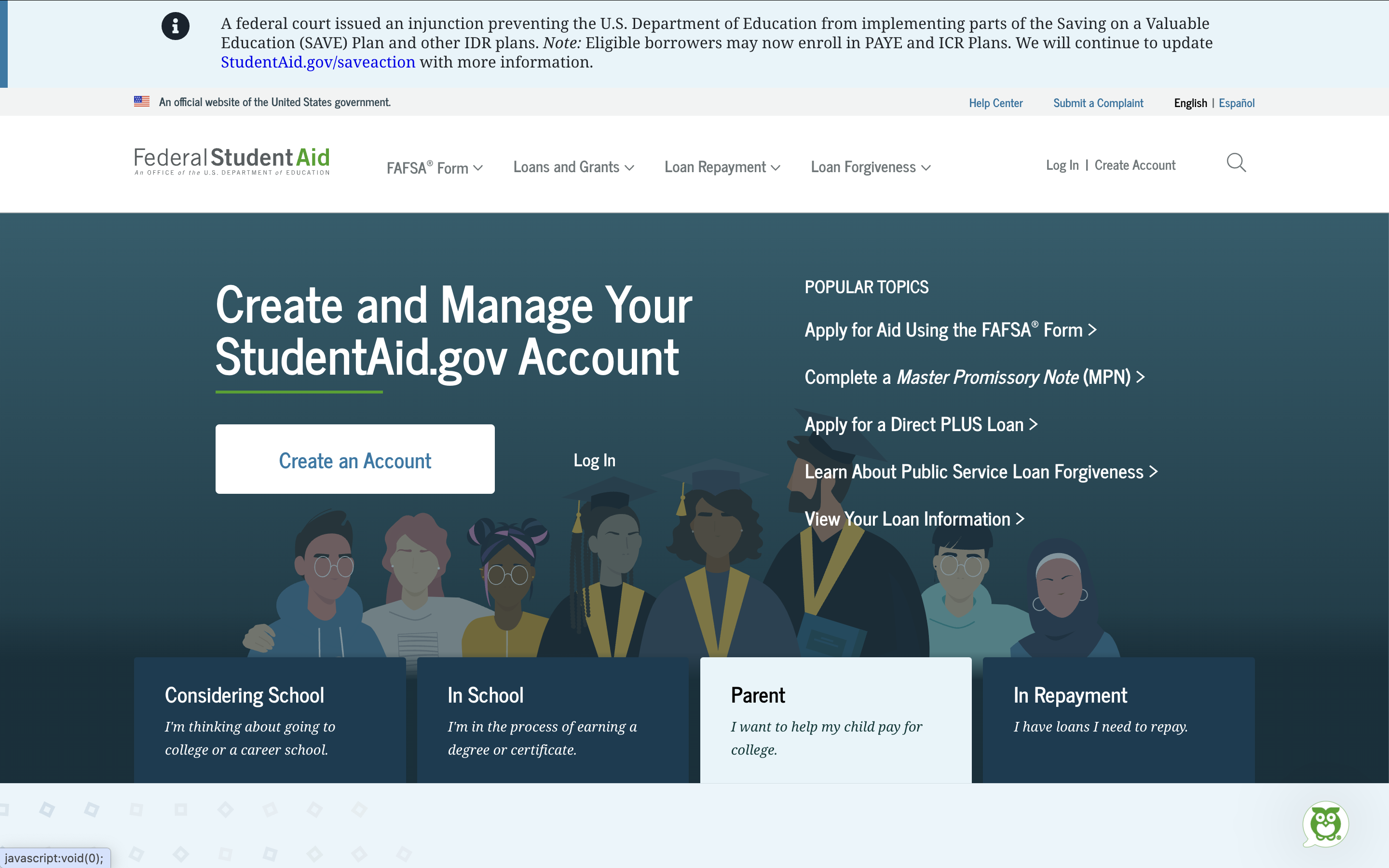

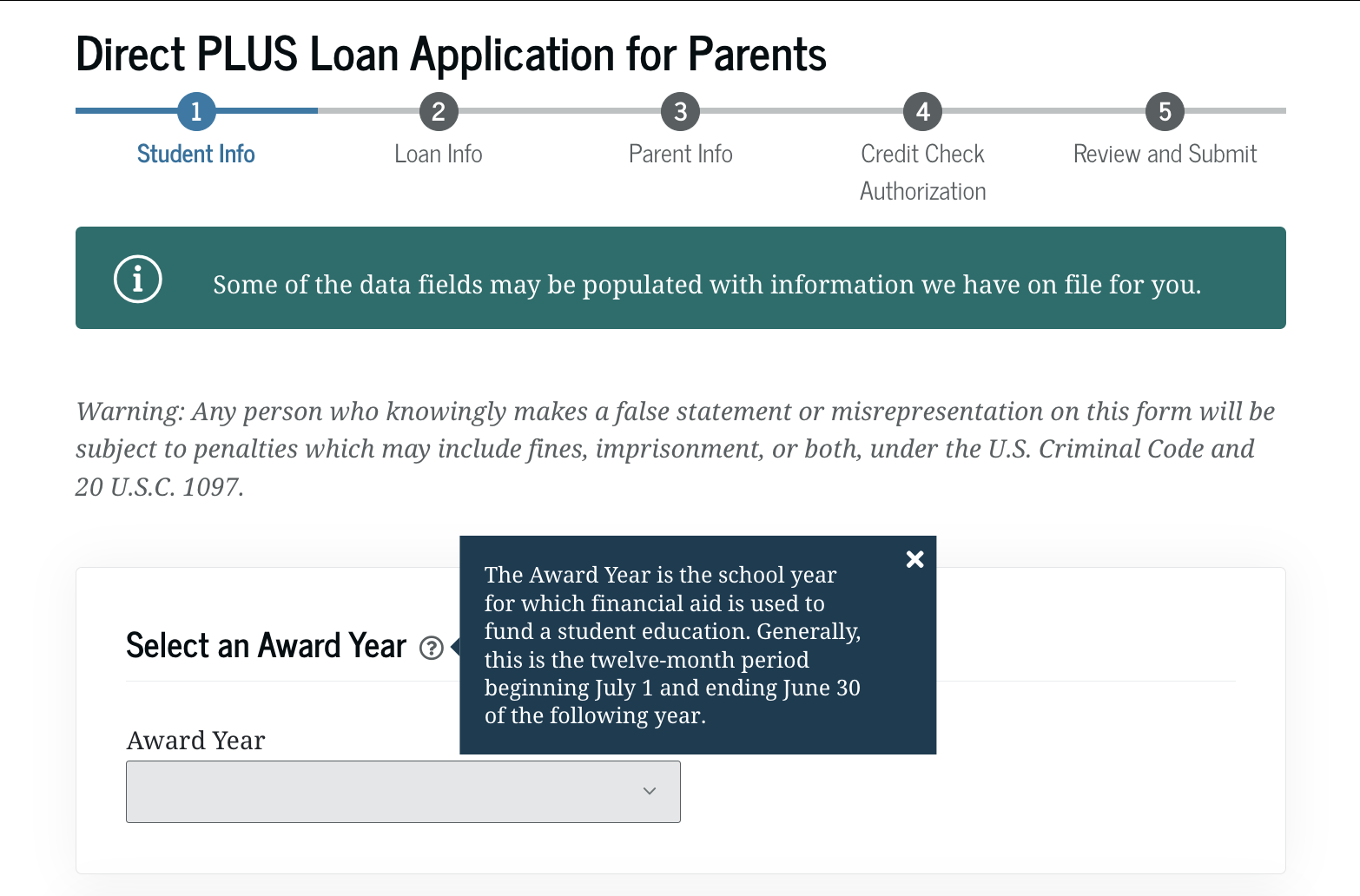

1.) Visit studentaid.gov

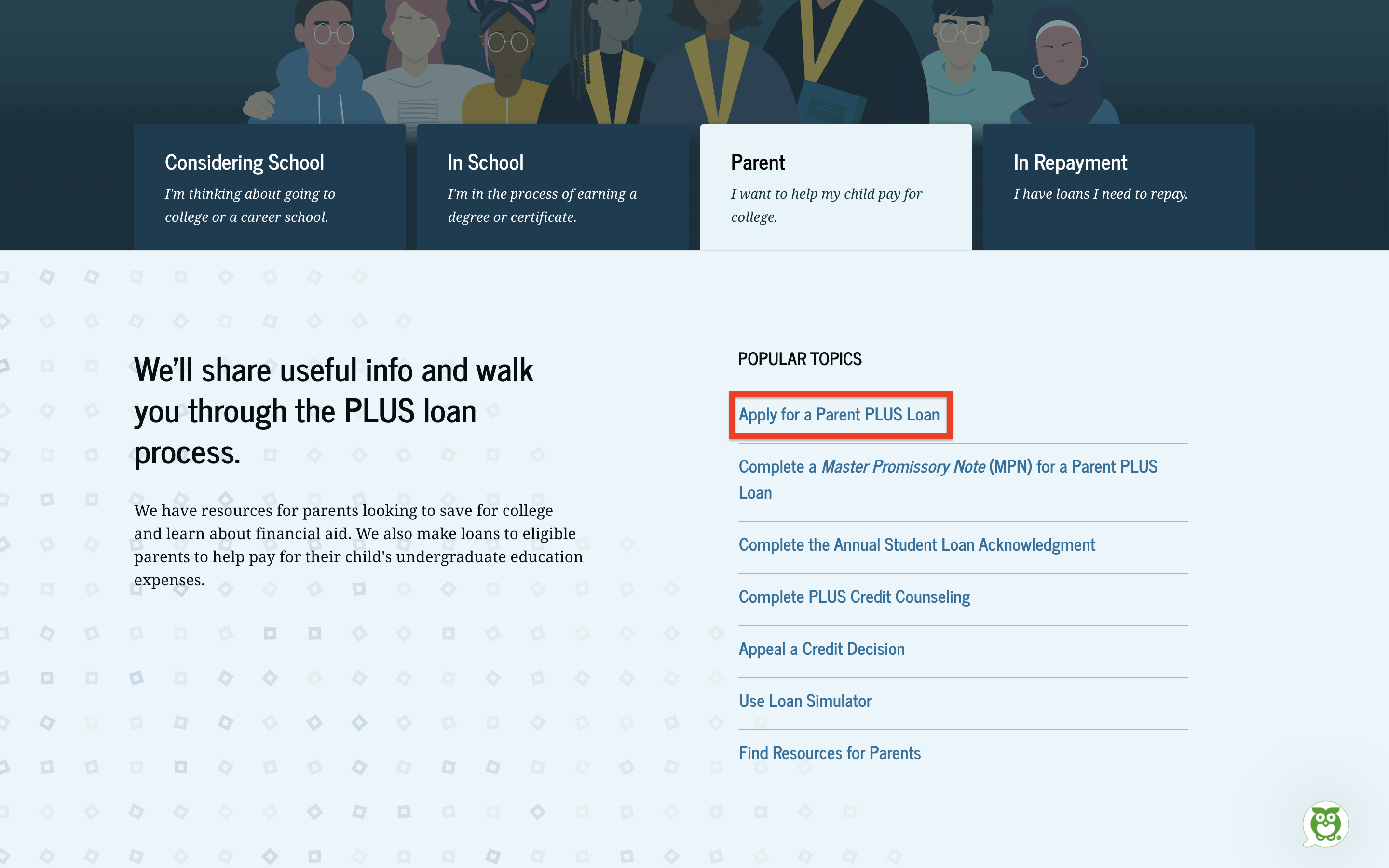

2.) Find and click the tab that states "Parent (I want to help my child pay for college)"

3.) Under the Parent tab, select the "Apply for a Parent PLUS Loan" option

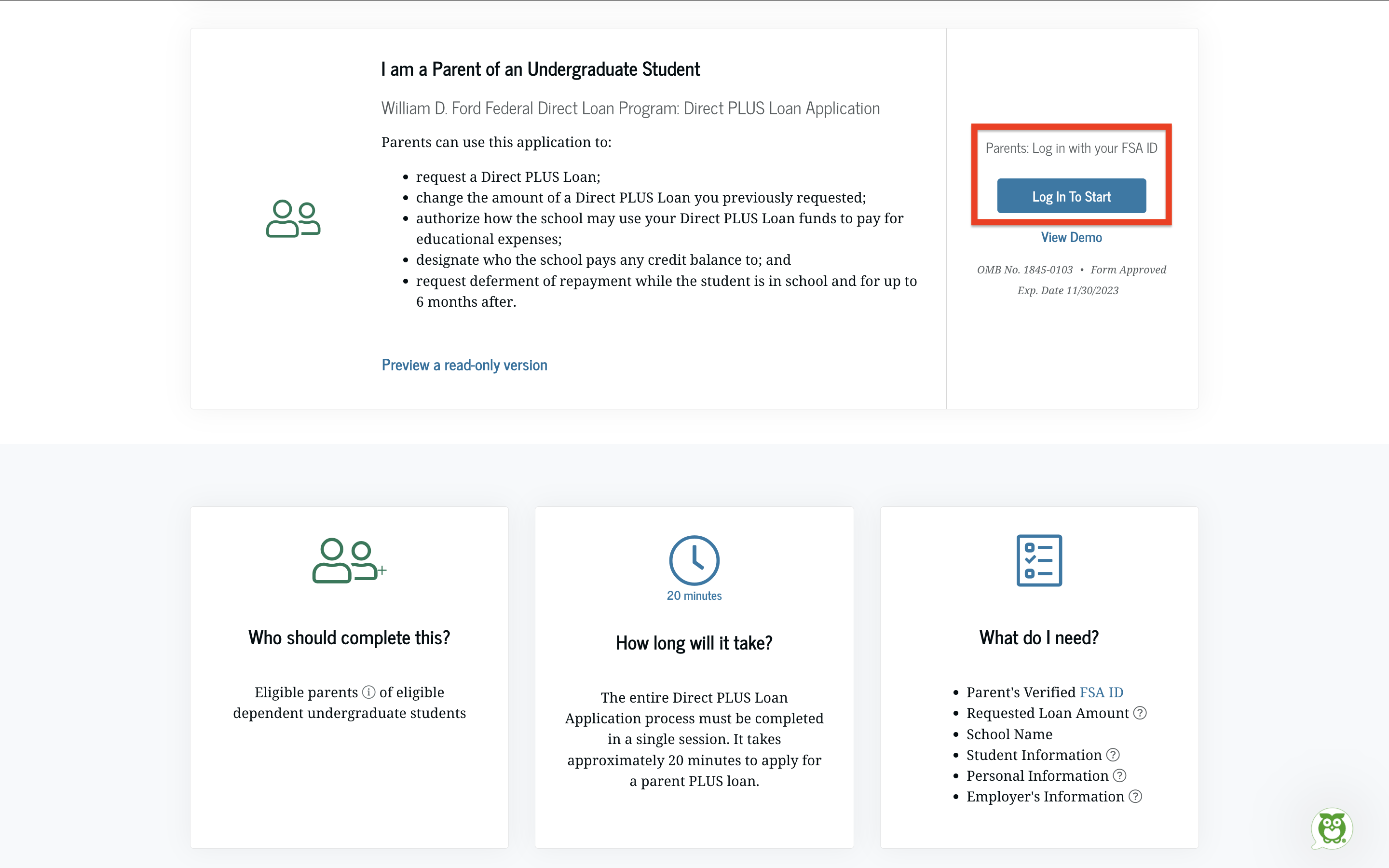

4.) Select the "Log In To Start" option to begin the application using the parent(s) studentaid.gov account

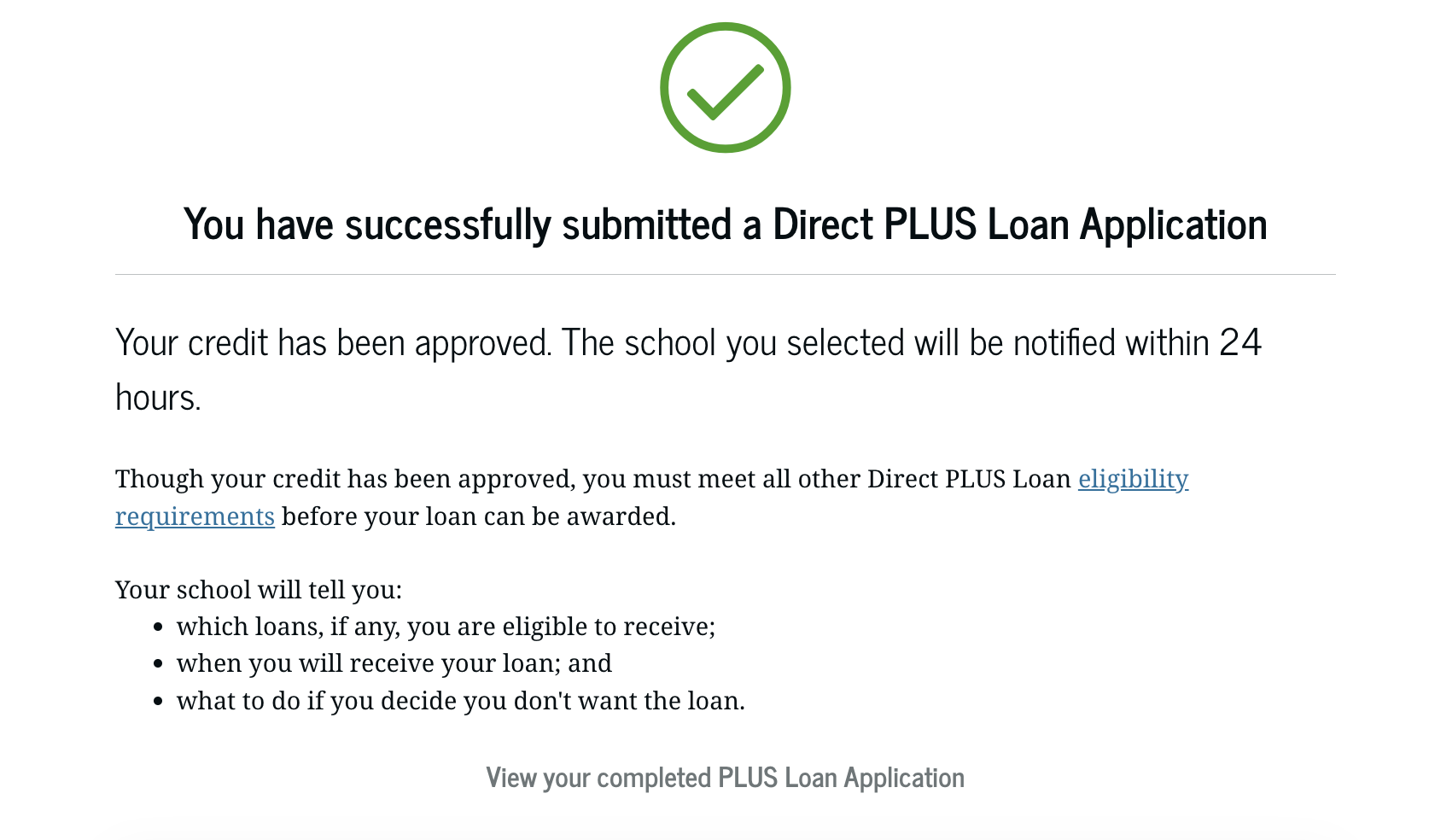

5.) If everything is done correctly, the parent applying will receive a confirmation at the end of the application that:

- The Parent PLUS Loan was successfully submitted

- The credit check was approved

Important Application Sections

Please review the academic year options that will be available for SF State for the Parent PLUS Loan application:

| Academic Year | Semesters |

|---|---|

| 2025-2026 | Fall 2025, Spring 2026, & Summer 2026 |

| 2024-2025 | Fall 2024, Spring 2025, & Summer 2025 |

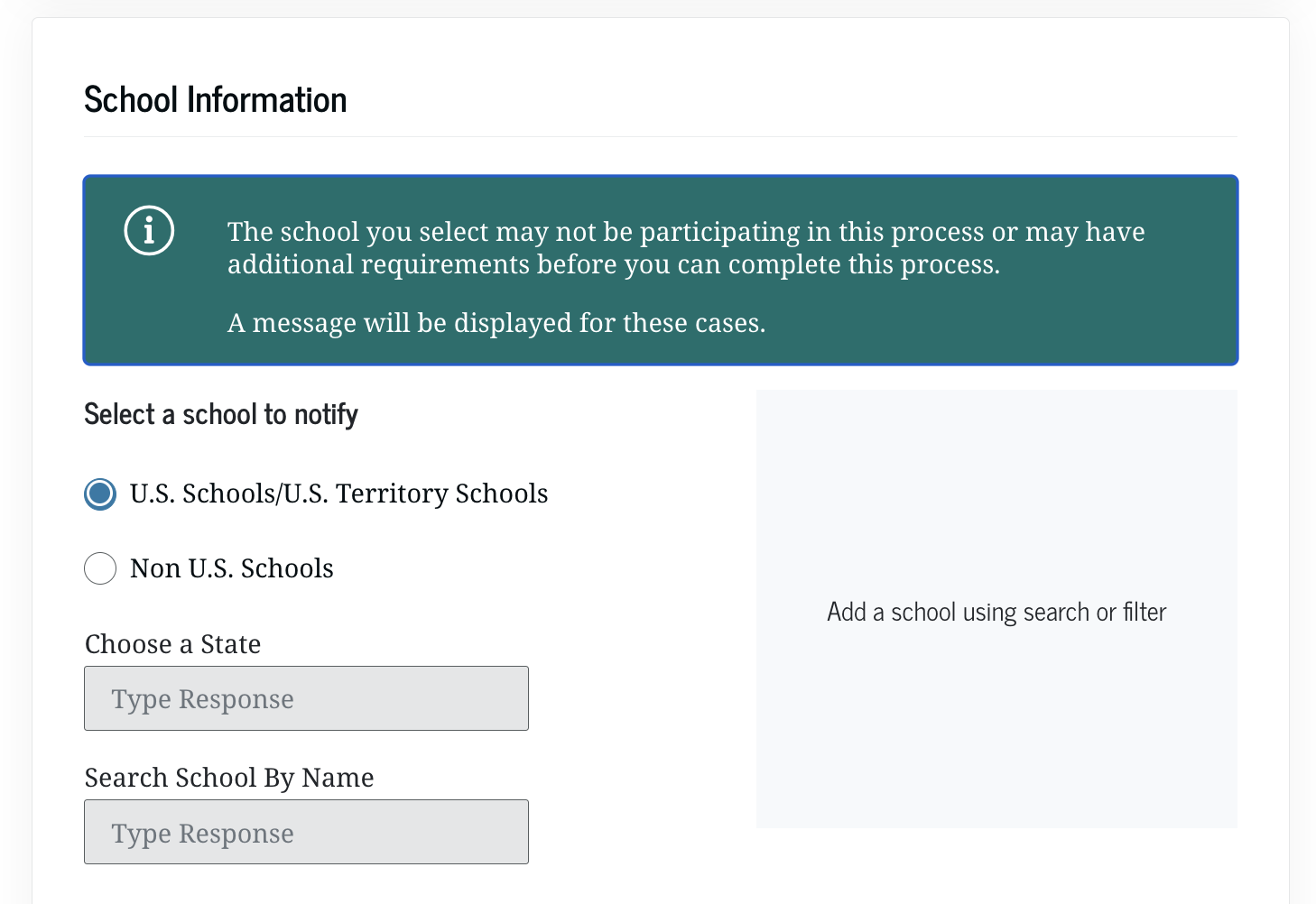

Federal School Code: 001154

Make sure to list San Francisco State University as the school of choice in the application.

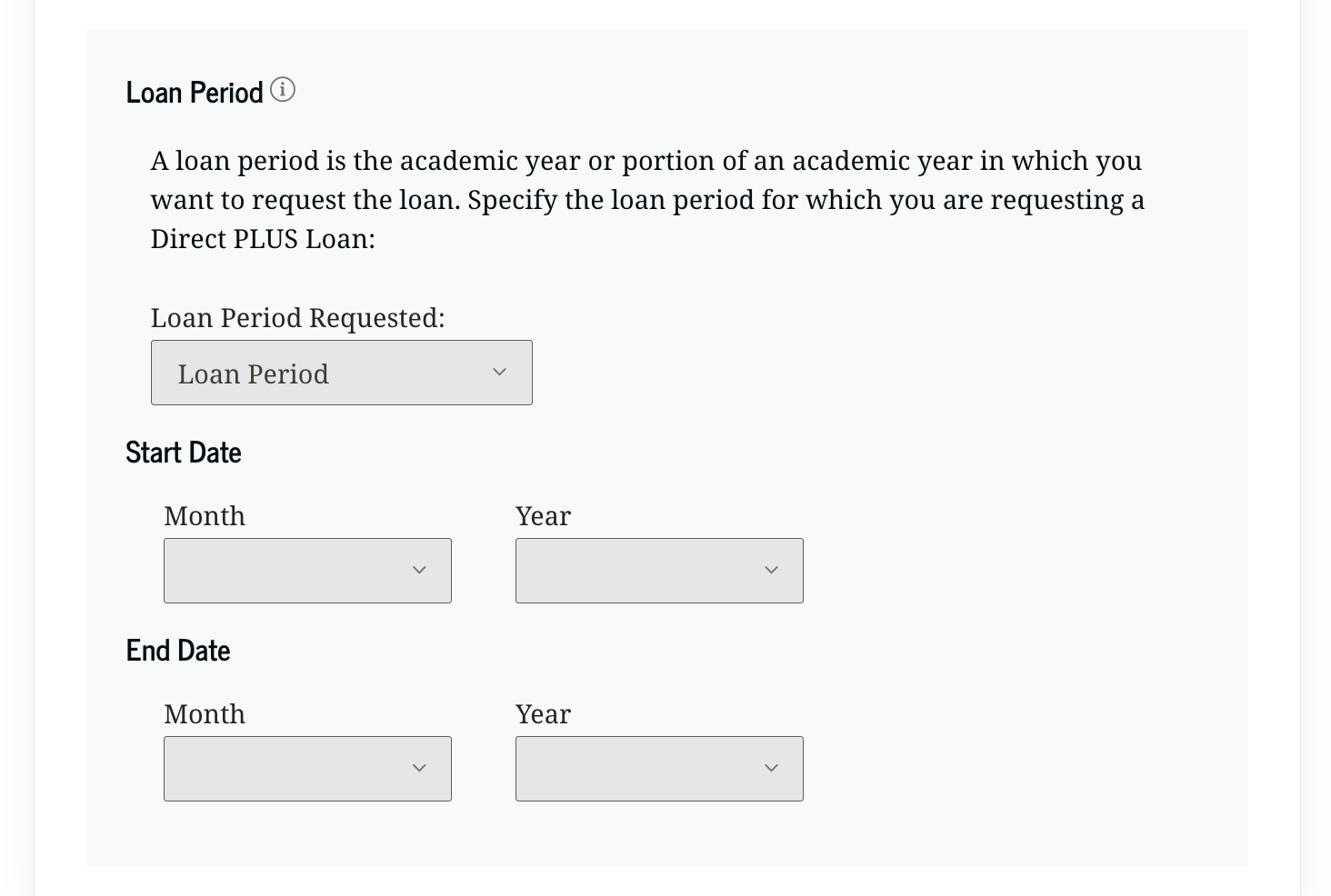

This section will confirm the academic year the Parent PLUS Loan will be used for and what months. In order to answer this section based on the student's dates of attendance, please review the table listed right below.

NOTE: Period listed is for the 2024-2025 school year (Fall 2024, Spring 2025, & Summer 2025)

| Semesters | Start Date | End Date |

|---|---|---|

| Fall/Spring | August 2024 | May 2025 |

| Summer | June 2025 | July 2025 |

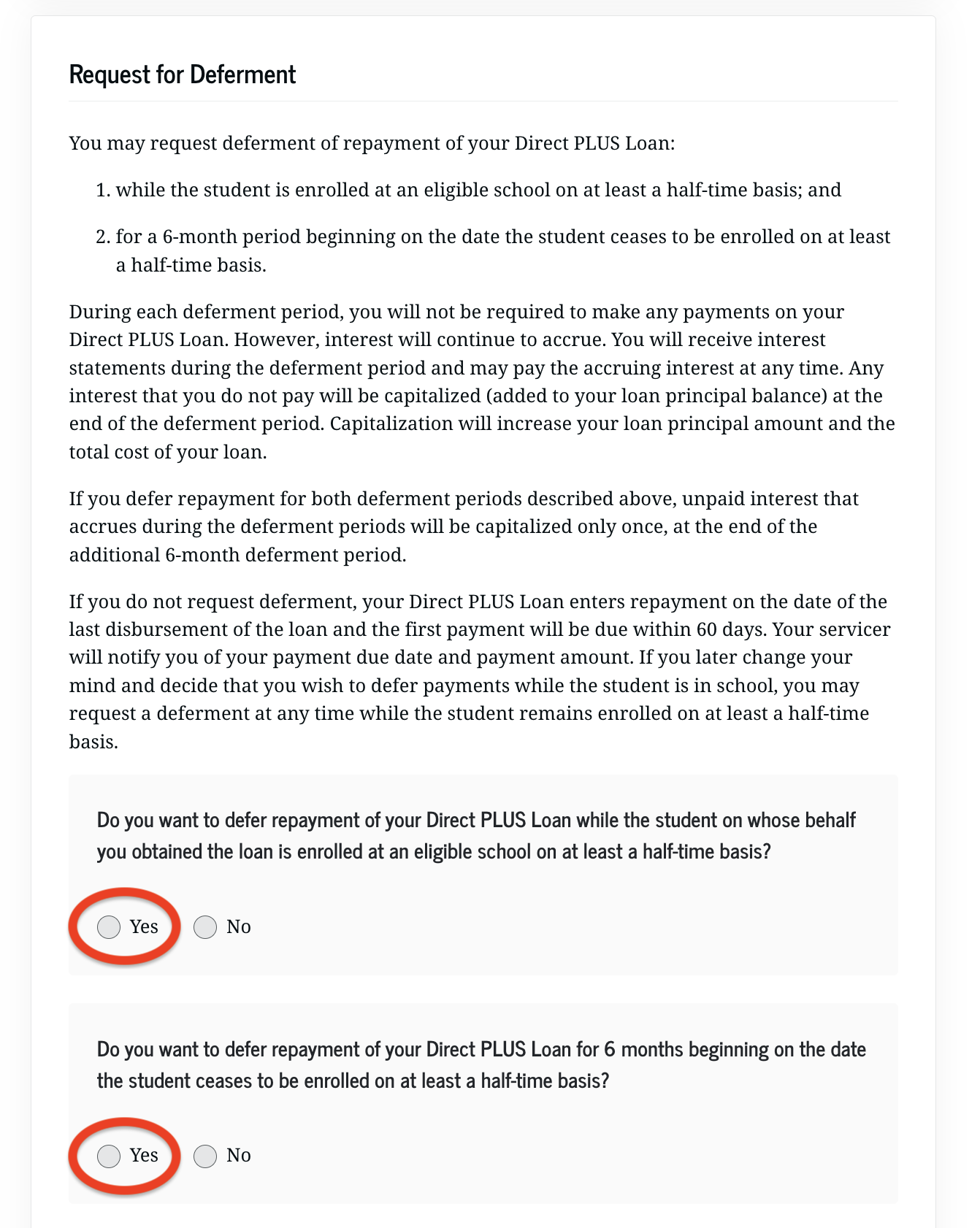

This section gives the parent the option to defer (Delay) the repayment of the Parent PLUS Loan. Select the "Yes" option to defer the repayment to 6 months after the student graduates or withdraws from school.

If the "No" option is selected, Loan repayment will begin 60 days after the Loan disburses here at SF State.

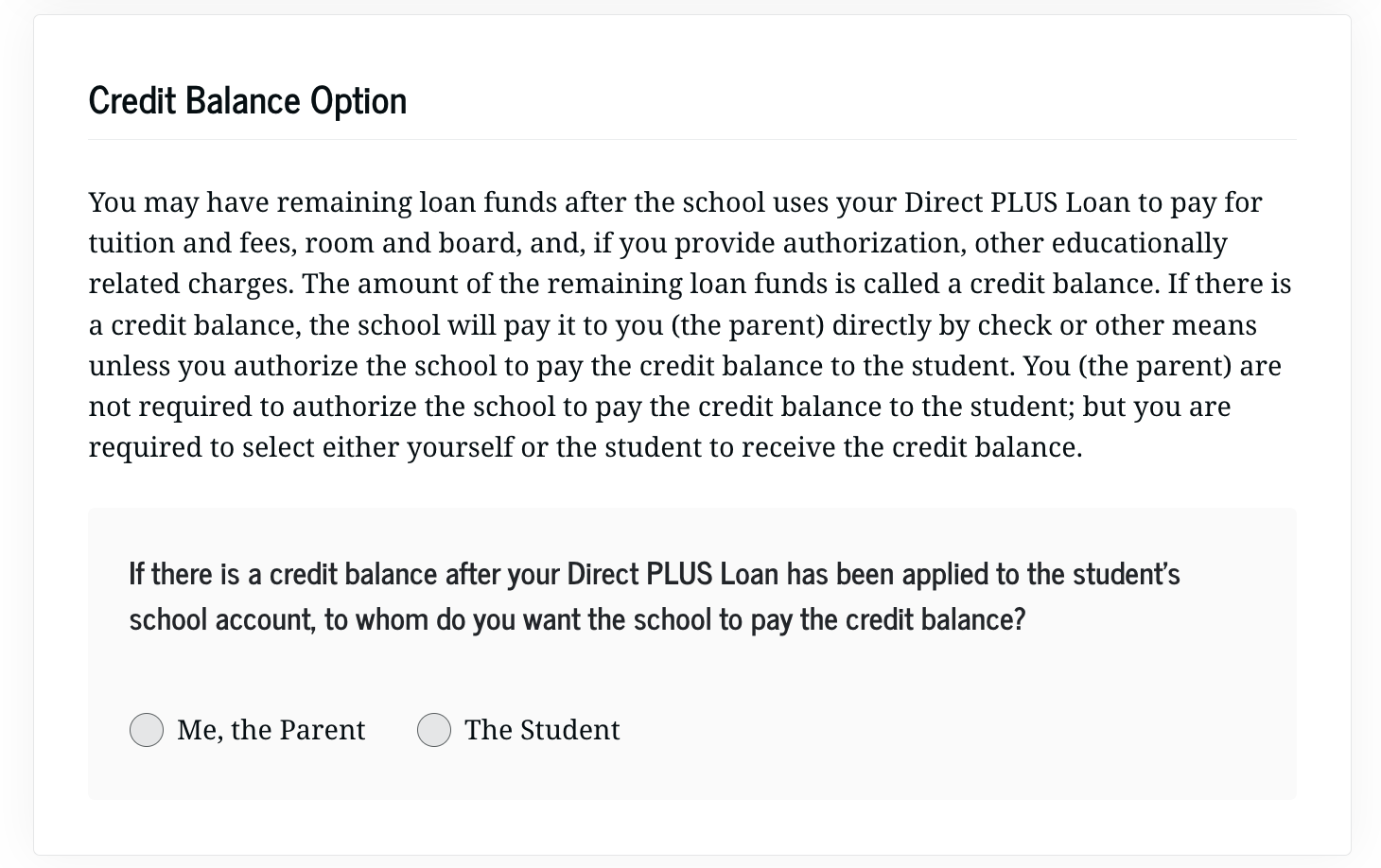

This section confirms who the Bursar's Office will issue refund to after all the charges are cleared with the student's account. This option cannot be changed after the application is successfully submitted. If it needs to be changed, the student will have to get in contact with our PLUS Loan Coordinator.

| Item | Description |

|---|---|

| Apply for Parent PLUS Loan | The application process of the actual Parent PLUS Loan which will require a credit approval in order to be eligible for the funds. |

| Master Promissory Note (MPN) for Parent PLUS Loan |

A legally binding agreement in which the Parent promises repay all Direct PLUS Loans a they will receive under the designated MPN for the PLUS Loan. NOTE: A Parent PLUS Loan MPN is good for 10 years and will only need to be completed again if a different parent applies. |

Parent(s), feel free to use the demo links provided right below in order to get a preview of how the Loan application and MPN signing will go.

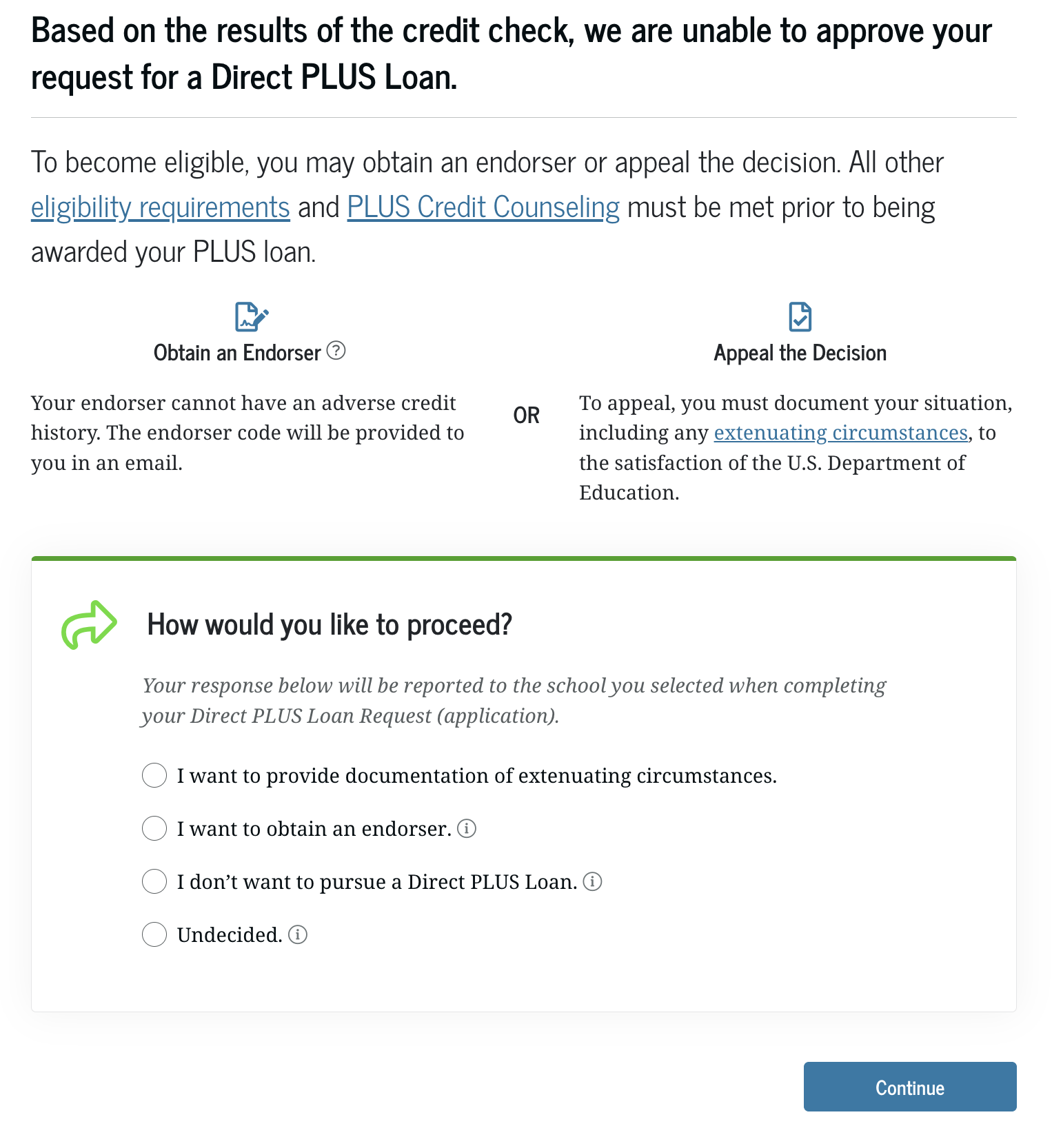

What happens if my Parents PLUS application is denied?

Appeal Process Steps:

- Submit an "Extenuating Circumstances Appeal" to Federal Student Aid (FSA)

- Once the appeal is approved, the parent must complete the "PLUS Loan Credit Counseling" in order for the Parent PLUS Loan to be successfully re-submitted

- Awarding of the Parent PLUS Loan may take another 2 to 3 weeks after the appealed credit decision is approved

Endorser Process Steps:

- Parent must find an endorser who will be willing to co-sign the Parent PLUS Loan

- The endorser will have to create a studentaid.gov account and complete the "Endorser Addendum"

- If the endorser is approved for a credit check, then the parent must complete these two items:

- PLUS Loan Credit Counseling

- Parent PLUS Loan MPN (For the endorsed Loan)

- Awarding of the Parent PLUS Loan may take another 2 to 3 weeks after all the steps needed are completed

There are a few factors that can cause a Parent to be ineligible for a Parent PLUS Loan:

- Poor credit score/history

- Parent is a non-eligible citizen or permanent resident

- Parent filed for bankruptcy

If a Dependent student is in need of additional funding but the Parent PLUS Loan is no longer an option due to the reasons listed above, they may submit a request for an Additional Unsubsidized Loan amount so that they may receive more funding based on their academic level.

| Academic Level | Amount (For the year) |

|---|---|

| Freshmen/Sophomore | $4,000 |

| Junior/Senior | $5,000 |

We highly recommend speaking to a Financial Aid Counselor with our office first before submitting this form. Please click on the link provided down below to complete the document.

No action will be taken by the school and the Parent PLUS Loan will never be awarded and disbursed for the designated school year requested.

Parent PLUS Loan Interest Rates & Fees

| Loan Type | Borrower Type | Fixed Interest Rate |

|---|---|---|

| Direct PLUS Loans | Parents and Graduate or Professional students | 8.94% |

| First disbursement Date | Loan Fee |

|---|---|

| On or after 10/1/20 and before 10/1/25 | 4.228% |

| On or after 10/1/19 and before 10/1/20 | 4.236% |

Frequently Asked Questions (FAQs) about Parent PLUS Loan Process

A student may complete a Parent PLUS Loan Change Request Form to increase/decrease amounts, cancel undisbursed amounts, and any other related action items regarding the PLUS Loan. We highly recommend speaking to a Financial Aid Counselor with our office first before submitting this form. Please click on the link provided down below to complete the document.

NOTE: Form is for the 2024-2025 school year (Fall 2024, Spring 2025, & Summer 2025)

- Parent must successfully complete Loan items for the Parent PLUS Loan and pass the credit check approval

- Student must be enrolled in half-time amount: 6 units for Undergraduates

- No financial aid related issues or items pending on the To Do List & Notifications sections of the SF State Gateway

- There is room to add the award in the student's Cost of Attendance (COA)

For more information regarding the financial aid disbursement process, please click on the link provided right below.

YES. As mentioned above, only if there is more room in the Cost of Attendance (COA). The Parent PLUS Loan is not a "Need based" aid and can be awarded as long as there is room to add it in the COA. If there is no more room in the student's COA, then they will need to do a budget appeal to see if it can possibly be increased.

Repayment and interest will apply to funds after the loan has been disbursed. The first payment of interest and principal are due within 60 days after the loan is fully disbursed. The parent may request an in-school deferment while the student is enrolled at least half time (6 undergraduate units). If the student drops to less than half time or withdraws during the period for which the loan was intended, the entire amount of the Parent PLUS Loan is immediately due.