Graduate PLUS Loans are borrowed funding that Graduate students can use to help pay for college or career school as provided by the U.S. Department Of Education (DOE). These Loans can help pay for education expenses not covered by other financial aid.

Get Coverage Now!

How do I apply for a Graduate PLUS Loan?

Awarding Timeframe - 2 to 3 weeks after successful application submission

For a step-by-step guide on how to apply for a Graduate PLUS Loan, please click on the guide provided right below.

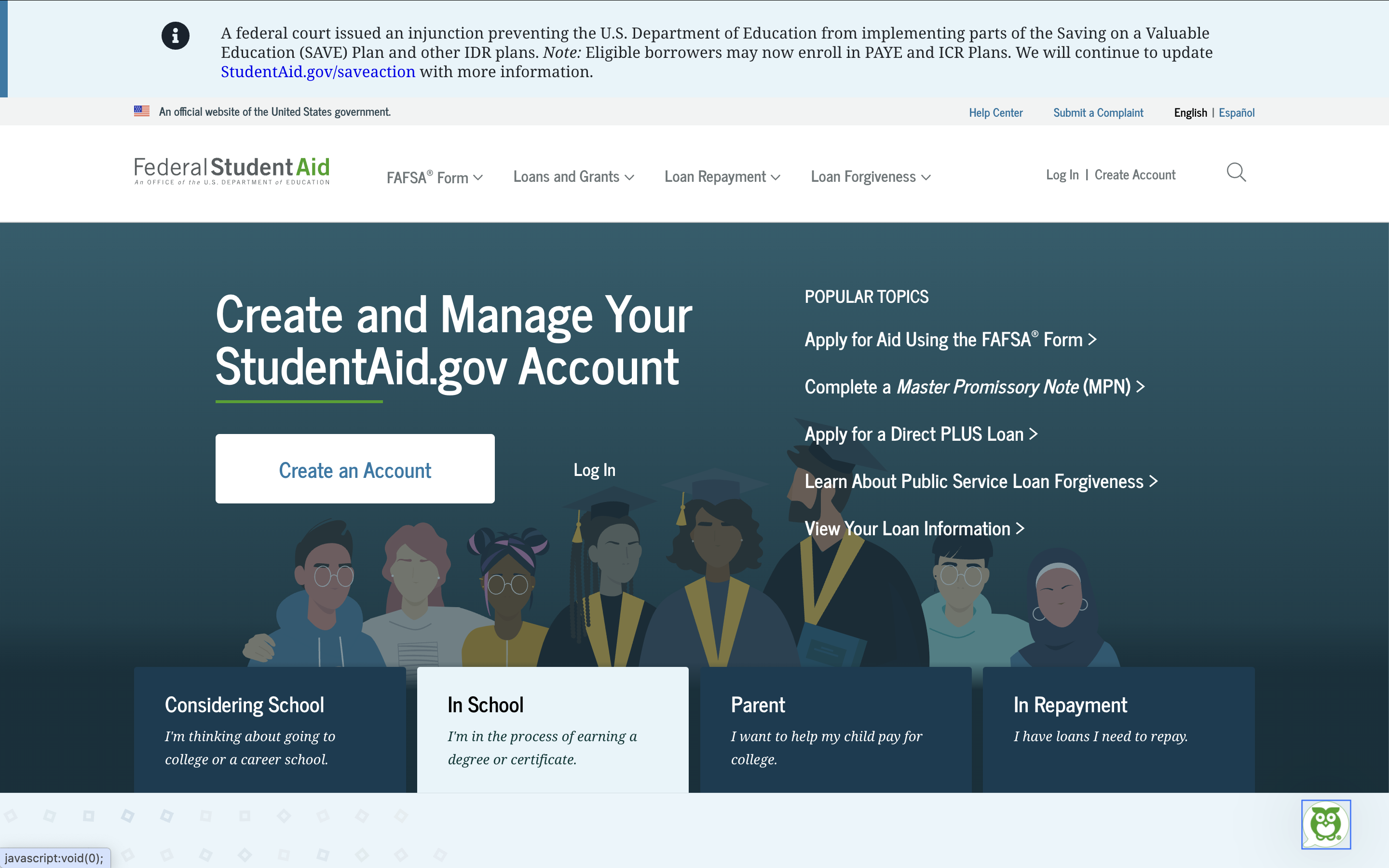

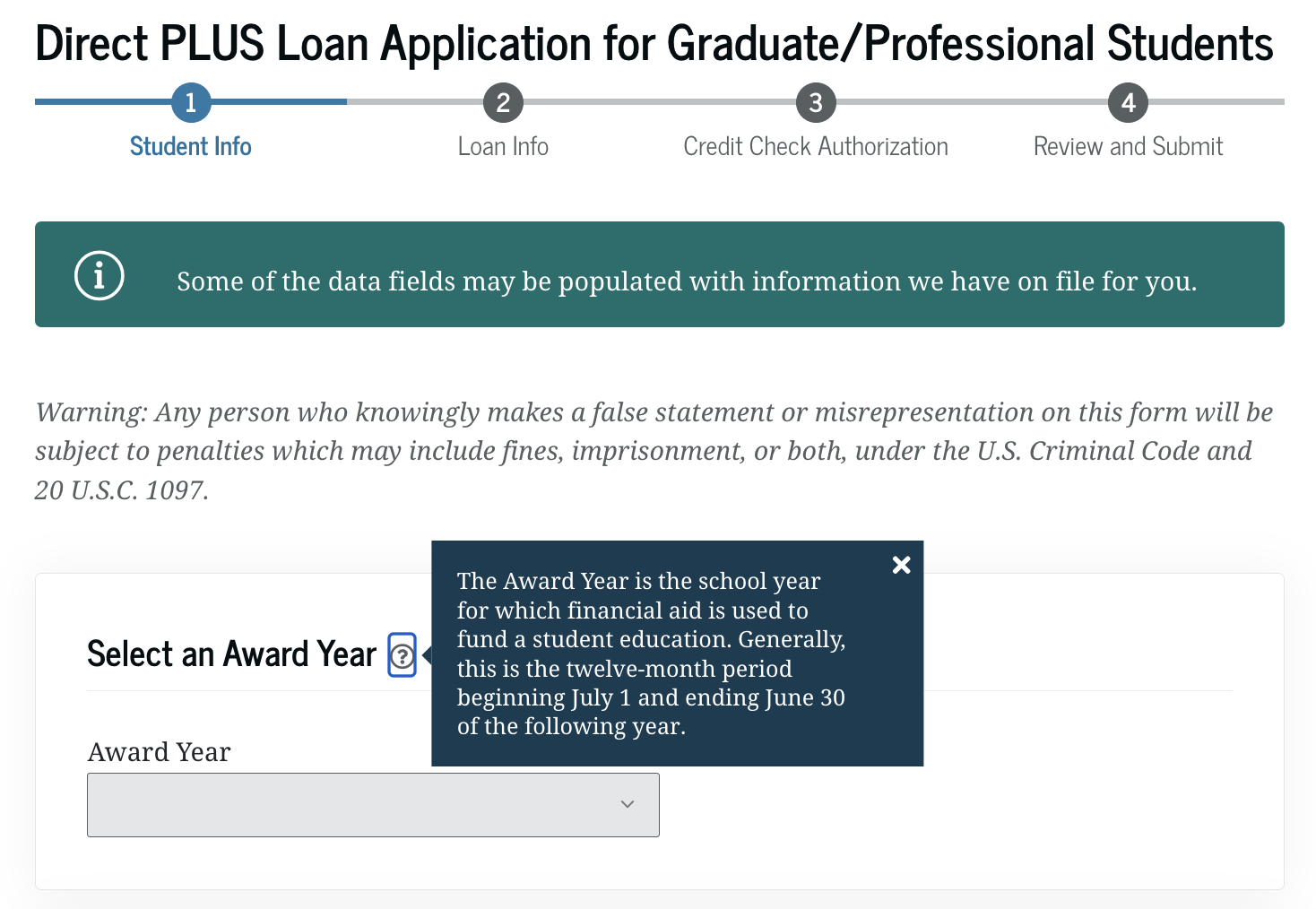

1.) Visit studentaid.gov

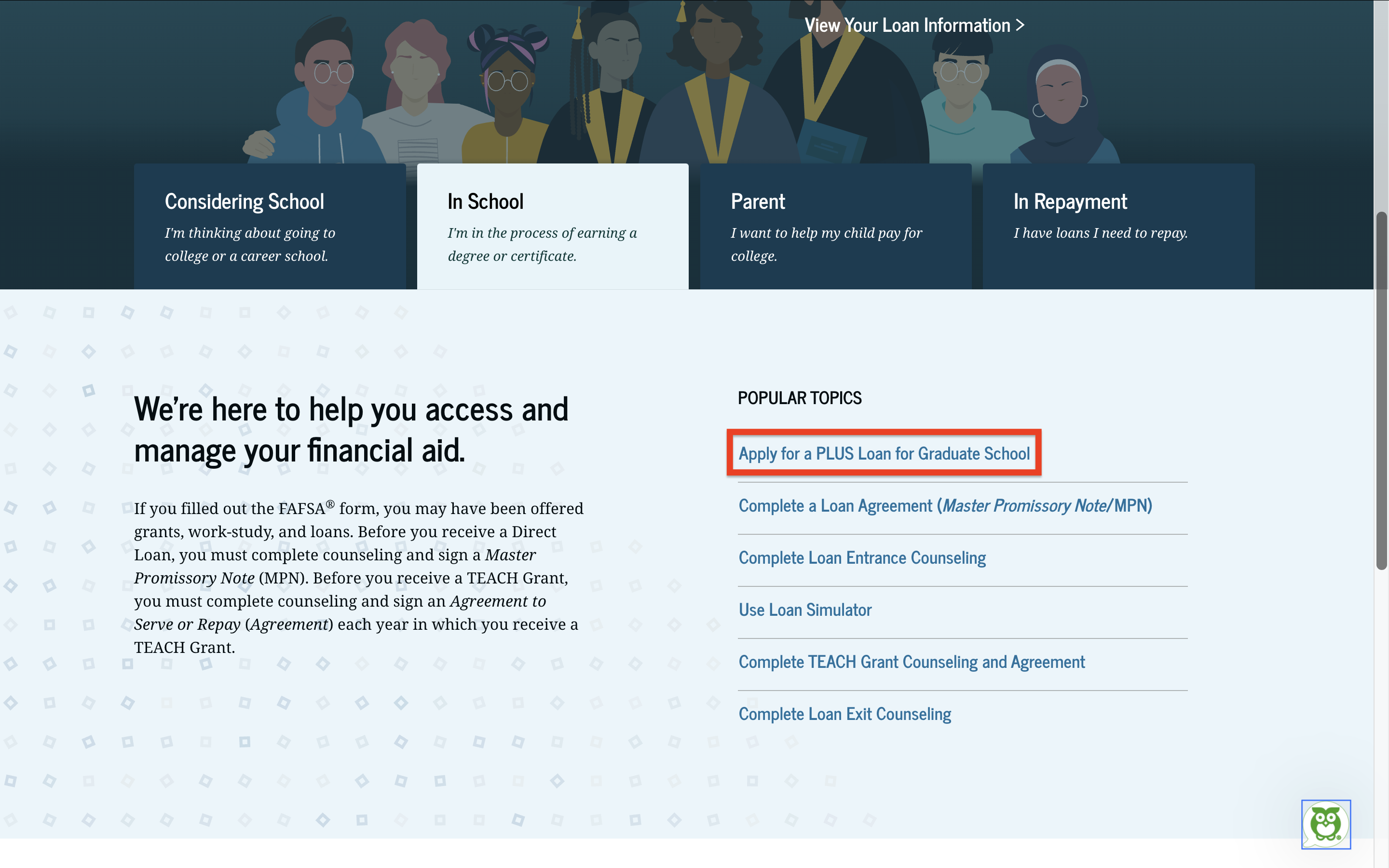

2.) Find and click the tab that states "In School (I'm in the process of earning a degree or certificate)"

3.) Under the In-School tab, select the "Apply for a PLUS Loan for Graduate School" option

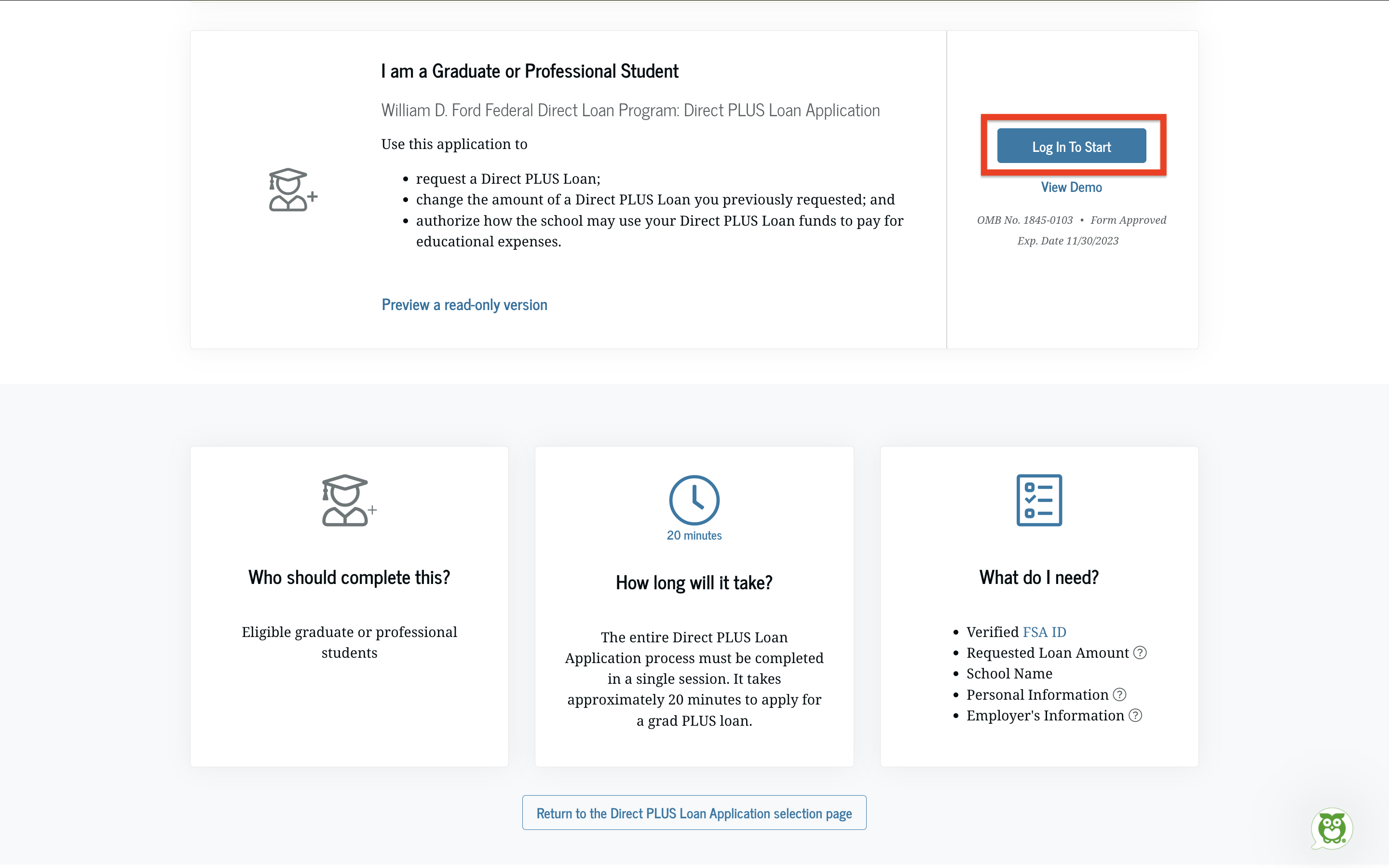

4.) Select the "Log In To Start" option to begin the application using the student's studentaid.gov account

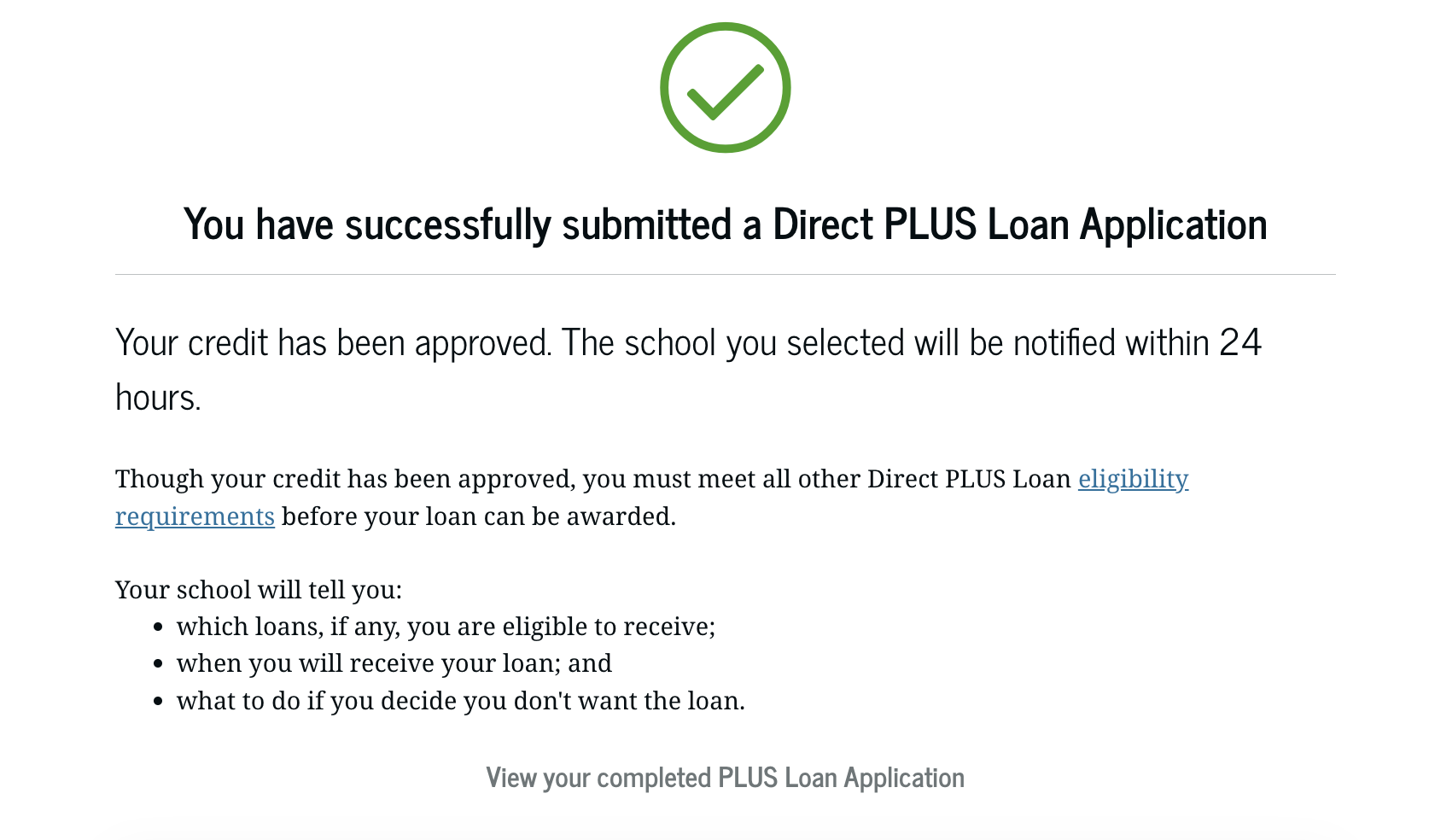

5.) If everything is done correctly, the parent applying will receive a confirmation at the end of the application that:

- The Graduate PLUS Loan was successfully submitted

- The credit check was approved

Important Application Sections

Please review the academic year options that will be available for SF State for the Graduate PLUS Loan application:

| Academic Year | Semesters |

|---|---|

| 2025-2026 | Fall 2025, Spring 2026, & Summer 2026 |

| 2024-2025 | Fall 2024, Spring 2025, & Summer 2025 |

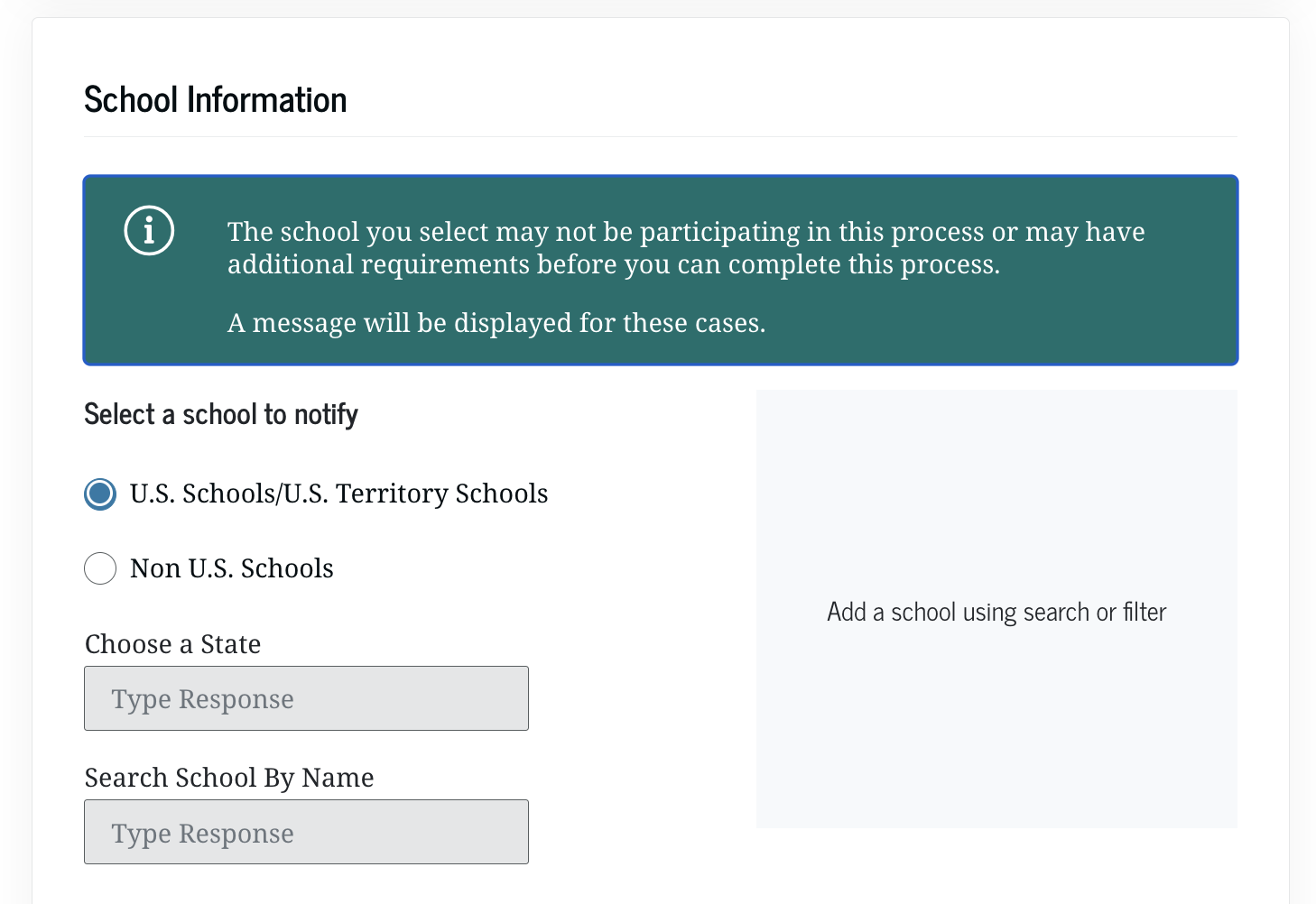

Federal School Code: 001154

Make sure to list San Francisco State University as the school of choice in the application.

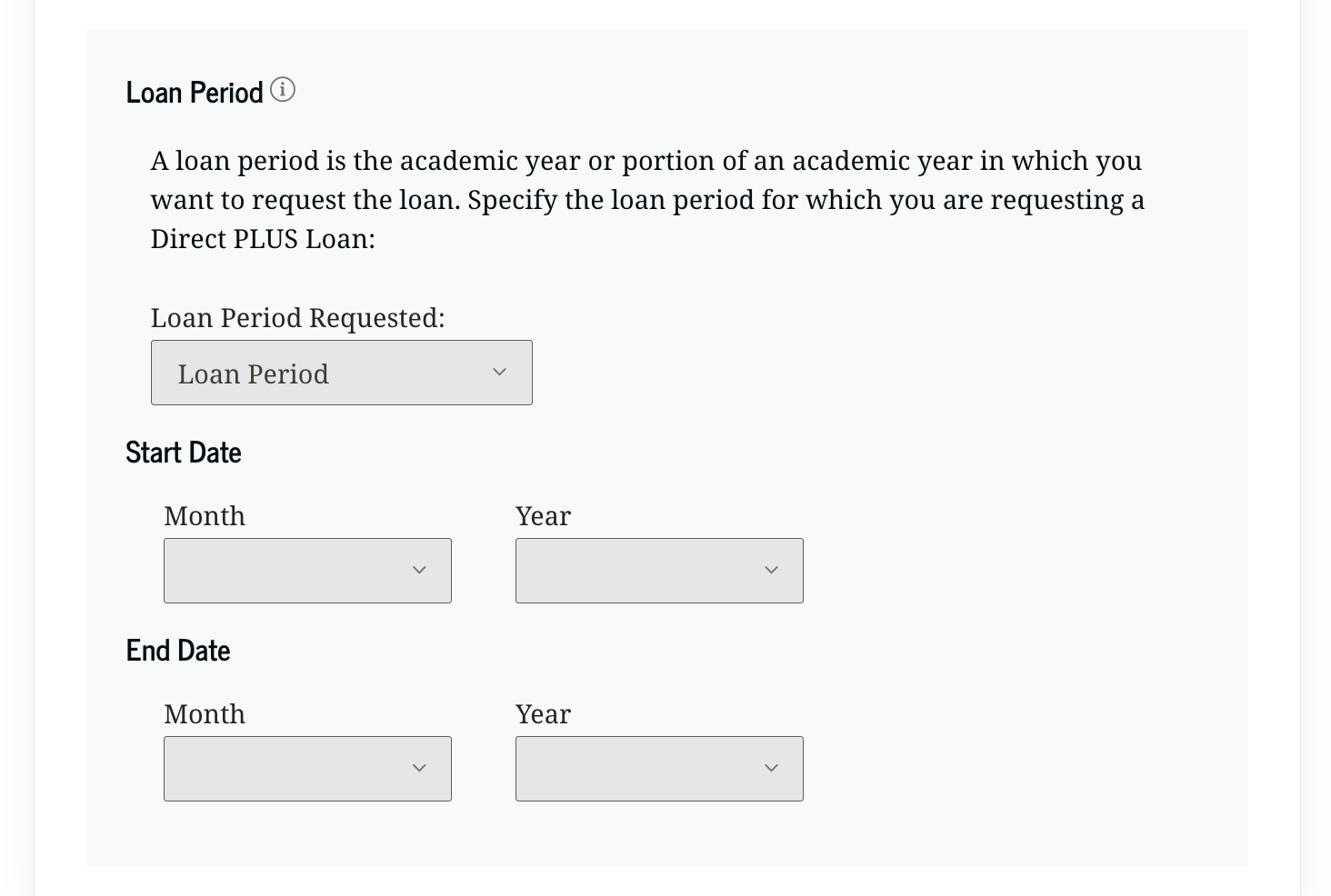

This section will confirm the academic year the Graduate PLUS Loan will be used for and what months. In order to answer this section based on the student's dates of attendance, please review the table listed right below.

NOTE: Period listed is for the 2024-2025 school year (Fall 2024, Spring 2025, & Summer 2025)

| Semesters | Start Date | End Date |

|---|---|---|

| Fall/Spring | August 2024 | May 2025 |

| Summer | June 2025 | July 2025 |

| Item | Description |

|---|---|

| Apply for Graduate PLUS Loan | The application process of the actual Graduate PLUS Loan which will require a credit approval in order to be eligible for the funds. |

| Master Promissory Note (MPN) for Graduate PLUS Loan |

A legally binding agreement in which the student promises repay all Direct PLUS Loans a they will receive under the designated MPN for the PLUS Loan. NOTE: A Graduate PLUS Loan MPN is good for 10 years and will only need to be completed again if the PLUS Loan was endorsed by another borrower. |

| Entrance Loan Counseling for Graduate PLUS Loans (For FIRST time borrowers only) | A module overview of how the Graduate PLUS Loan process works - What a Loan is, how interest works, options for repayment, and how to avoid delinquency and default. |

Feel free to use the demo links provided right below in order to get a preview of how the Loan application and MPN signing will go.

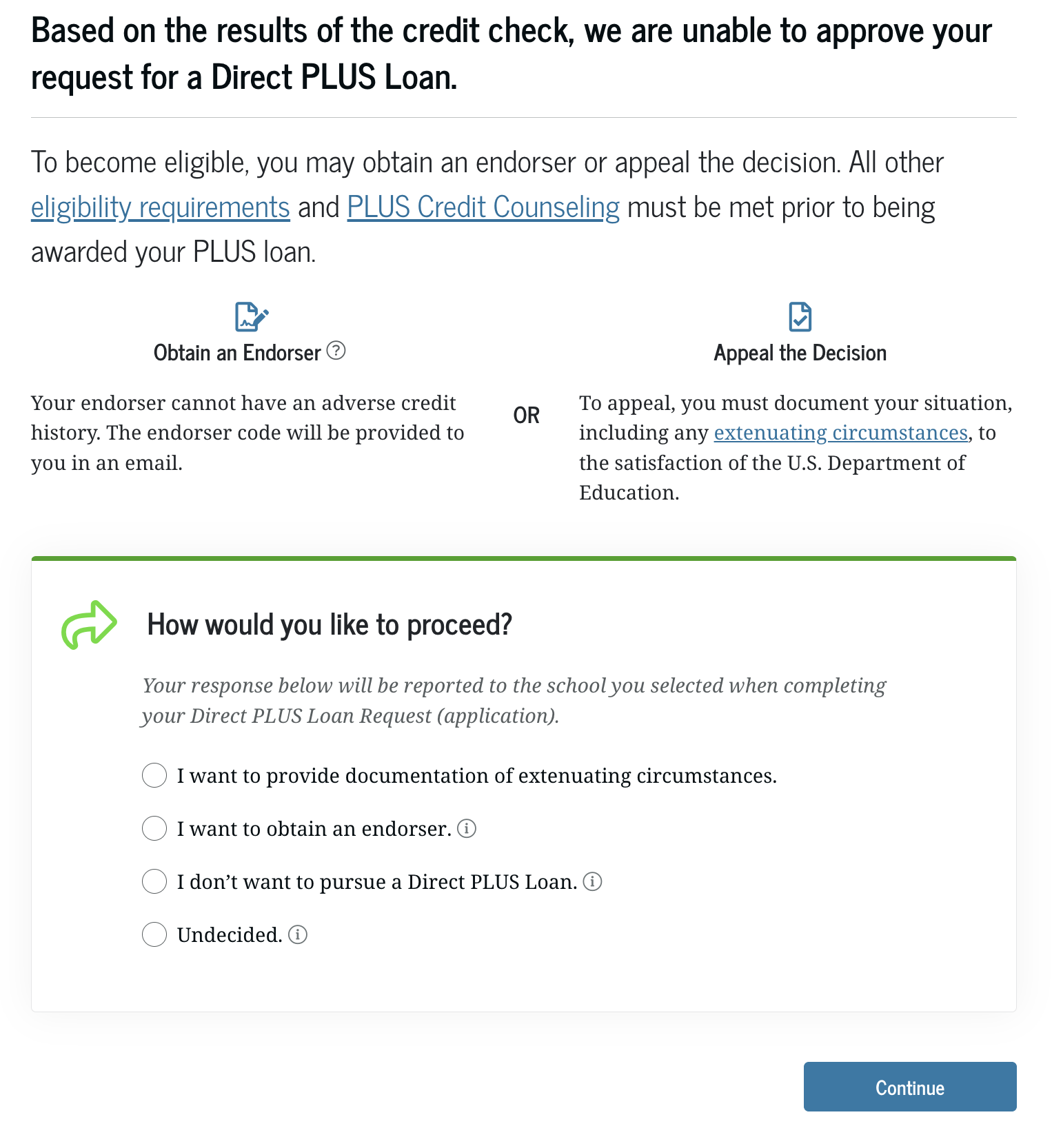

What happens if my Graduate PLUS application is denied?

Appeal Process Steps:

- Submit an "Extenuating Circumstances Appeal" to Federal Student Aid (FSA)

- Once the appeal is approved, the parent must complete the "PLUS Loan Credit Counseling" in order for the Graduate PLUS Loan to be successfully re-submitted

- Awarding of the Graduate PLUS Loan may take another 2 to 3 weeks after the appealed credit decision is approved

Endorser Process Steps:

- Student must find an endorser who will be willing to co-sign the Graduate PLUS Loan

- The endorser will have to create a studentaid.gov account and complete the "Endorser Addendum"

- If the endorser is approved for a credit check, then the student must complete these two items:

- PLUS Loan Credit Counseling

- Graduate PLUS Loan MPN (For the endorsed Loan)

- Awarding of the Graduate PLUS Loan may take another 2 to 3 weeks after all the steps needed are completed

No action will be taken by the school and the Graduate PLUS Loan will never be awarded and disbursed for the designated school year requested.

Graduate PLUS Loan Interest Rates & Fees

| Loan Type | Borrower Type | Fixed Interest Rate |

|---|---|---|

| Direct PLUS Loans | Parents and Graduate or Professional students | 8.94% |

| First disbursement Date | Loan Fee |

|---|---|

| On or after 10/1/20 and before 10/1/25 | 4.228% |

| On or after 10/1/19 and before 10/1/20 | 4.236% |

Frequently Asked Questions (FAQs) about Graduate PLUS Loan Process

A student may complete a Graduate PLUS Loan Change Request Form to increase/decrease amounts, cancel undisbursed amounts, and any other related action items regarding the PLUS Loan. We highly recommend speaking to a Financial Aid Counselor with our office first before submitting this form. Please click on the link provided down below to complete the document.

NOTE: Form is for the 2024-2025 school year (Fall 2024, Spring 2025, & Summer 2025)

- Student must successfully complete Loan items for the Parent PLUS Loan and pass the credit check approval

- Student must be enrolled in half-time amount: 4 units for Graduate level

- No financial aid related issues or items pending on the To Do List & Notifications sections of the SF State Gateway

- There is room to add the award in the student's Cost of Attendance (COA)

For more information regarding the financial aid disbursement process, please click on the link provided right below.

YES. As mentioned above, only if there is more room in the Cost of Attendance (COA). The Graduate PLUS Loan is not a "Need based" aid and can be awarded as long as there is room to add it in the COA. If there is no more room in the student's COA, then they will need to do a budget appeal to see if it can possibly be increased.

Interest fees will apply to the Loan after it has been disbursed. However, the student should automatically be eligible for a Deferment (Delay) with their Loan repayment as long as they are enrolled in at least half-time status with the school. If the student drops to less than half time or withdraws during the period for which the Loan was intended, the entire amount of the Graduate PLUS Loan is immediately due with their designated Loan servicer.