Here at SF State, we take the time to personally consider each individual student and their family's financial circumstances. We make every effort to be as accommodating as possible when re-evaluating a student's financial eligibility due to extenuating circumstances beyond their control. Please feel free to review the appeals we have listed right below and determine which one may apply to yours and your family's situation.

Appeals Breakdown

How do I submit my appeal documents?

Starting with the Fall 2025 semester, all appeals must be submitted through Student Forms. For a detailed breakdown on how to create an account to submit your appeals, please click on the link guide provided right below.

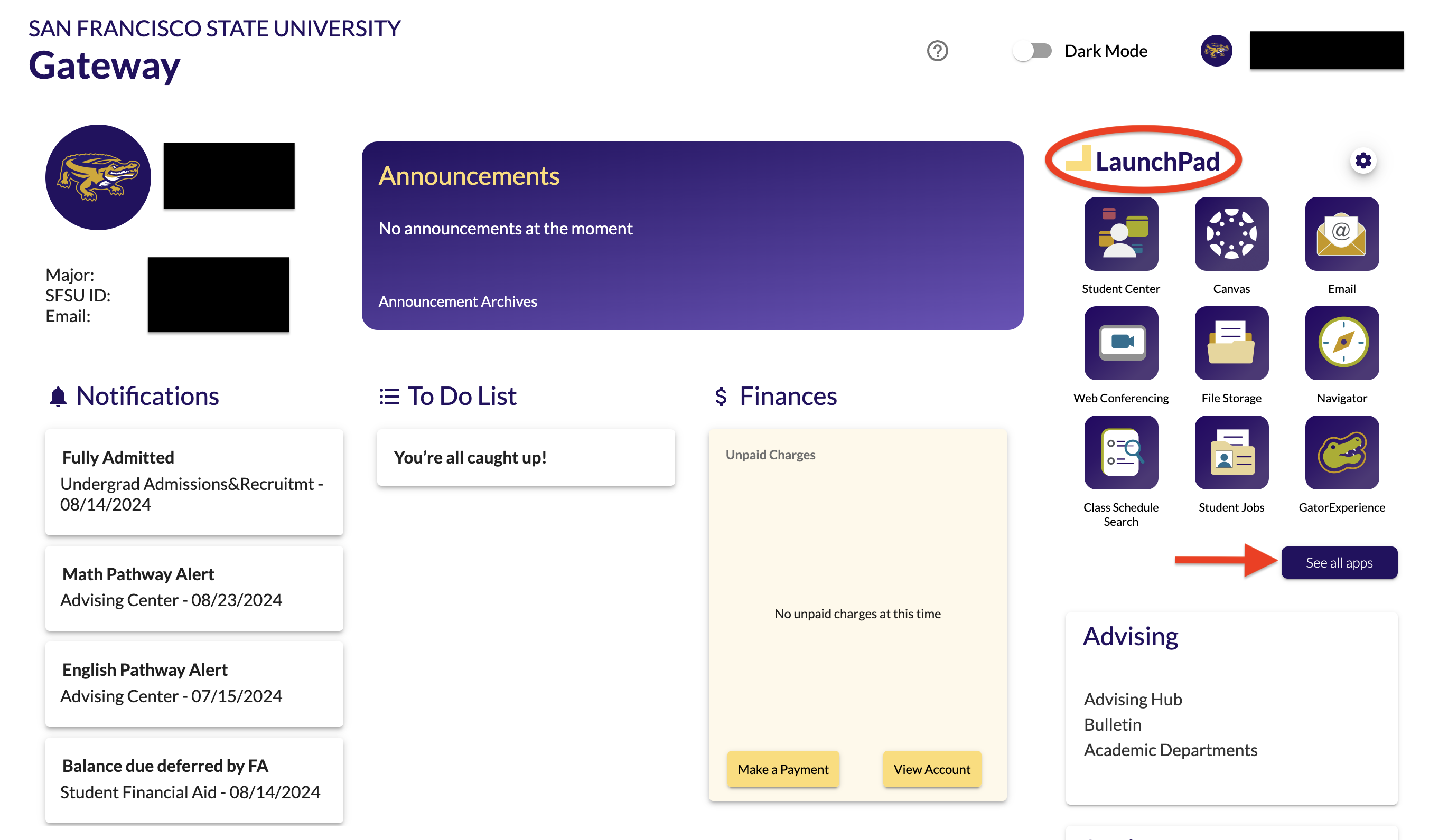

1.) Log on to your SF State Gateway with your SF State Login

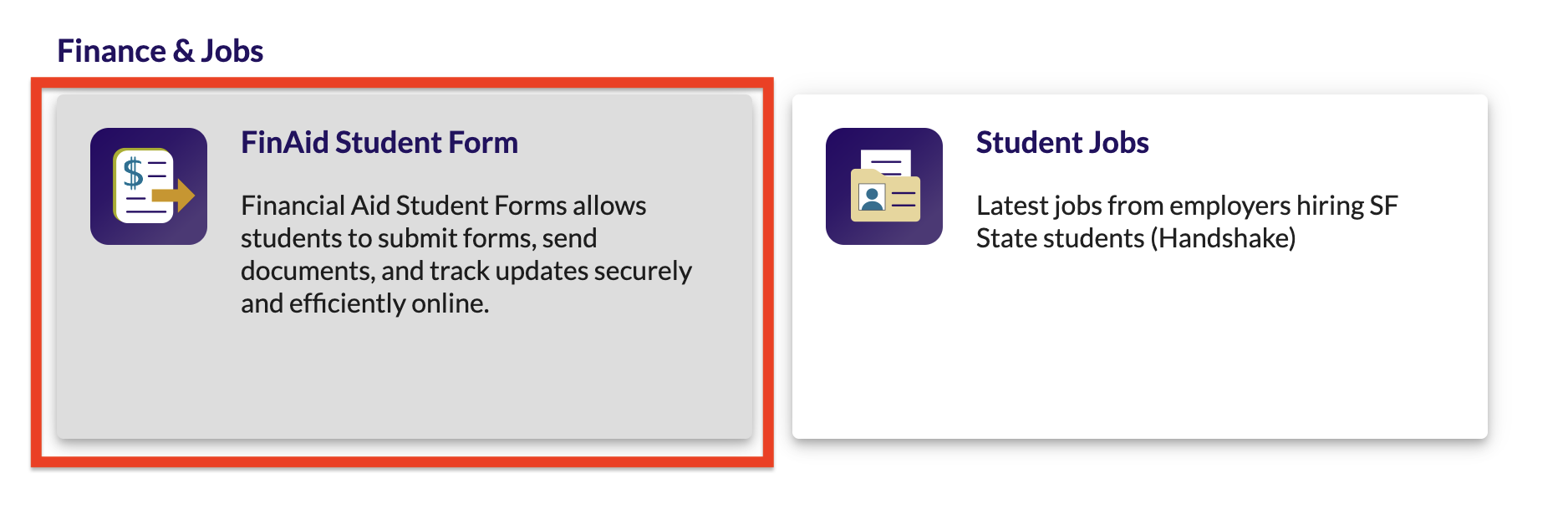

2.) Find the Launchpad section of your Gateway and click on "See all apps"

3.) Scroll to the Finance & Jobs section and click on the "FinAid Student Form" button to access the online submission link

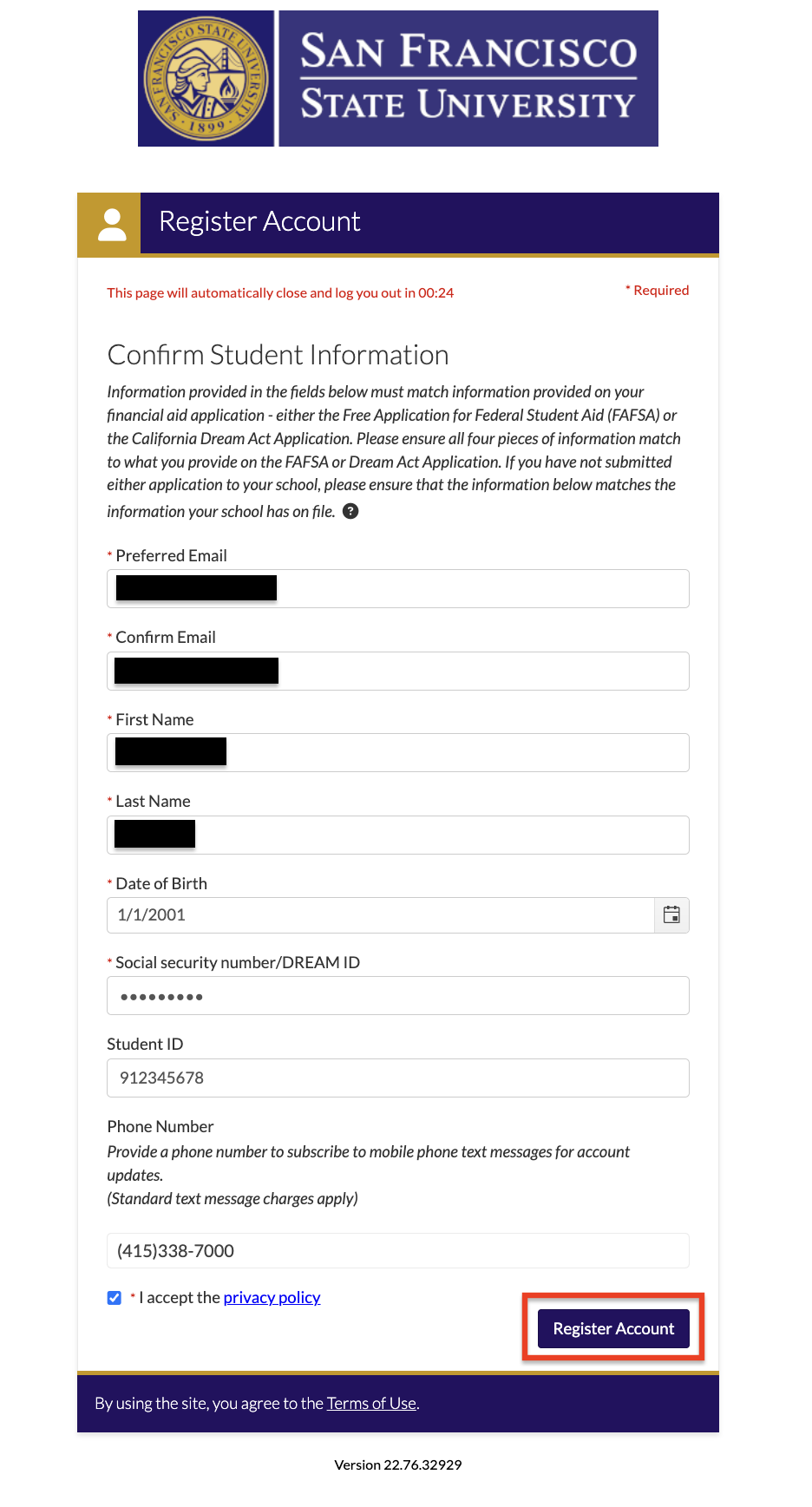

4.) After clicking the link, it will prompt you to create an account if you haven't already. Answer the personal questions listed and click on the "Register" button to finish the account creation process

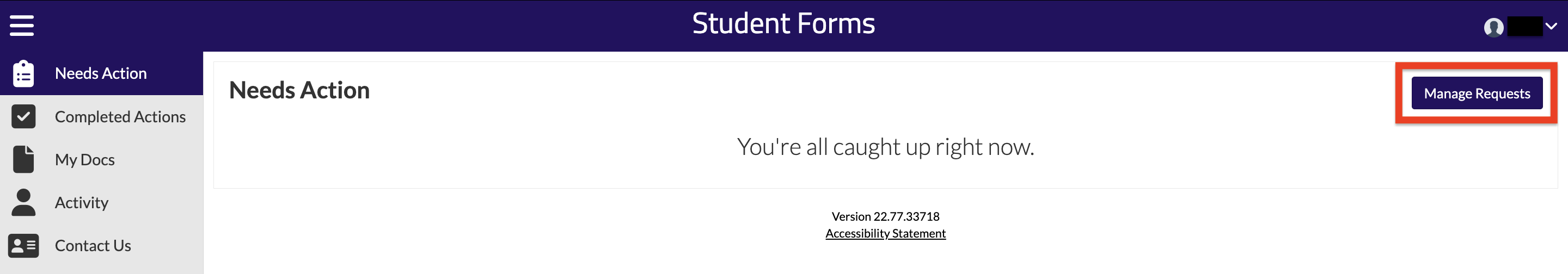

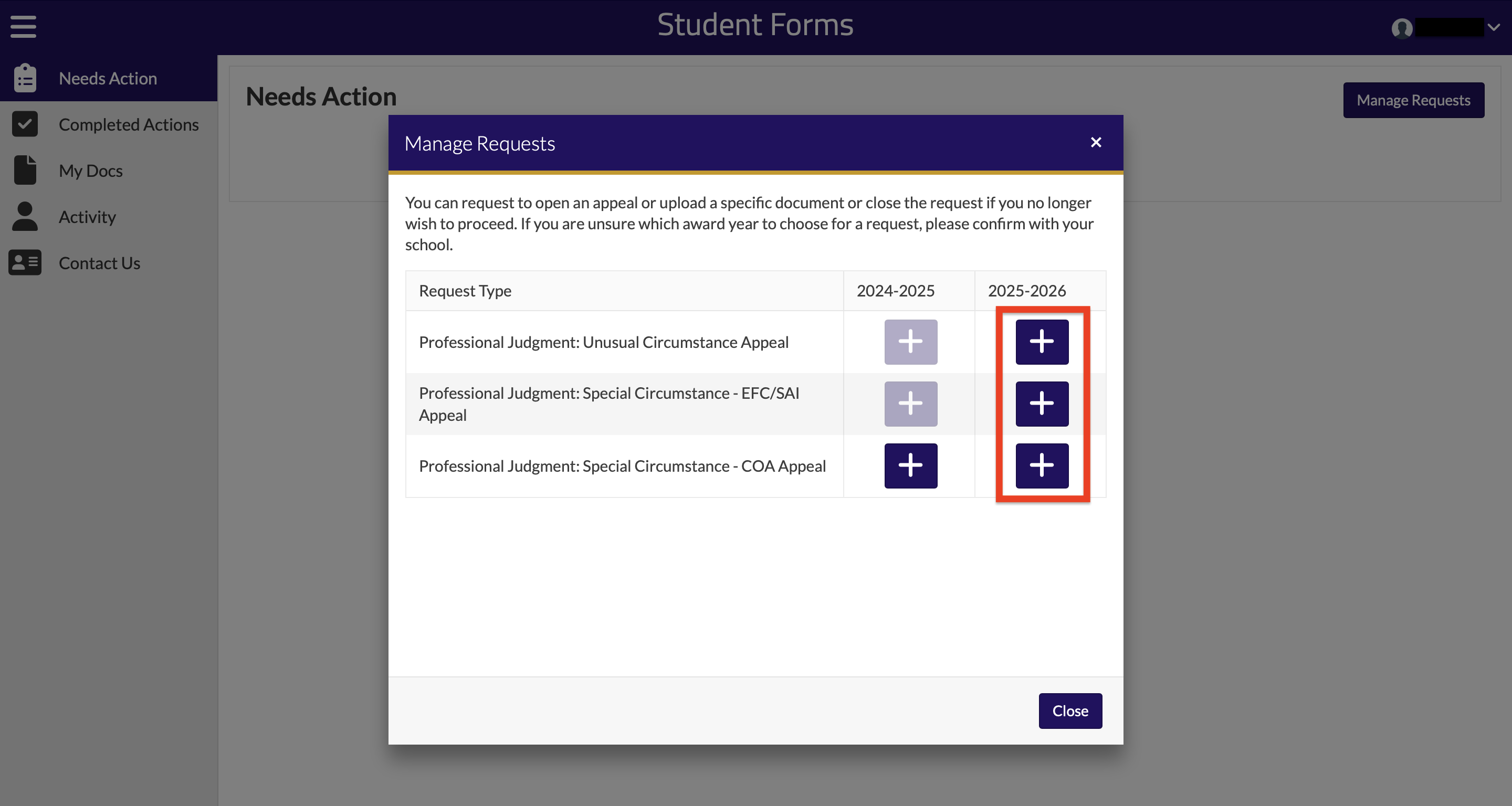

5.) Once logged in, on top right corner of the page, click on "Manage Requests" button

6.) Review the appeal options that are listed and determine which applies to your situation. Make sure you are on the correct school year and click on the "Plus symbol" to begin completing the appeal form.

Cost Of Attendance (COA) Appeal

This appeal does not increase Grant or Direct Loan amounts. If approved, it can only increase PLUS Loan and Alternative Loan amounts awarded to the student.

Formerly known as the "Budget Increase Request," this appeal is a request to re-consider a student's allowed Cost Of Attendance (COA). Every student is given a set budget for each academic year. However, we understand that there may be situations that where students will need to increase their budget because they need to make room for additional aid towards their educational expenses (Ex. Loans, Scholarships outside of FAFSA/CADAA, Stipends, etc.). The COA appeal is an option students may take in order to increase their budget to cover additional educational expenses.

- Computer purchase (Allowed only once during the student’s academic career)

- Departmental expenses required for major

- Medical or dental expenses

- Mileage

- Child care expenses

- Increase in Housing payments

- Other - Depending on professional judgment used by Financial Aid Counselor reviewing paperwork

- Increase Grant amounts

- Increase Federal Direct Loan amounts

- Paying past due charges for previous semesters

- Paying off credit card debt

- Non educational expenses for personal reasons

Student Aid Index (SAI) Appeal

Formerly know as the "Special Circumstances Petition (SCP)", this appeal is a request students and their families may take to communicate with our office about income changes that could not be reflected or explained on the FAFSA.

As a reminder - Only Undergraduate students with a Student Aid Index (SAI) greater than 0 can be considered. Students with an SAI of -1500 or 0 are already being awarded the maximum Pell Grant amount. Unfortunately, AB 540 Dream students and Graduate students cannot submit this petition due to the limited financial aid options available to them.

- Loss or reduction of income, including but not limited to loss of employment, reduction of pay, death of a parent or spouse, and reduction/loss of child support

- Divorce or separation

- One time only income distributions

- High out of pocket medical and/or dental expenses

- K-12 private school tuition, or tax liens

- Costs associated with a natural disaster

- Changes to assets or inability to liquidate assets;

- Loss of overtime or bonus

- Bankruptcy, foreclosures or collection costs associated with outstanding debt

- Consumer debt (credit cards, car payments, loans, etc.)

- Lottery or gambling winnings or losses

- One-time income used for non-life essential items (e.g., family vacation)

- Parents (step-parents or biological parents) who do not wish to provide support

- Marital separation where the parents are still living together

Unusual Circumstances Appeal

Formerly known as a "Dependency Override," this appeal is a request to re-consider a student's dependency status, which is determined by the U.S. Department of Education (DOE). According to DOE, students aged 23 years old or younger are automatically considered as a “Dependent" for financial aid purposes. Students working or living apart from their Parent(s) does not constitute “Independent” status - Regardless whether their Parent(s) support them financially or not.

However, students may submit an appeal to override their dependency status and be considered an independent based on unusual circumstances. As a reminder - This is not a guaranteed process. A designated Financial Aid Counselor will be assigned to your appeal and make the determination whether the override request can be approved.

Students must clearly demonstrate an adverse family situation in order to be considered independent for financial aid purposes:

- Human trafficking

- Legal refugee or asylum status

- Severe parental abandonment or estrangement

- Student or parental incarceration

- Abusive home environment (physical or emotional abuse).

- Student is homeless or at risk of homelessness.

- Student is an unaccompanied youth.

Unusual circumstances do not include:

- Parent(s) unwilling to provide information in the student's FAFSA/CADAA

- Parent(s) refusal to contribute to a the student's education costs

- Parent(s) do not claim the student as a dependent for income tax purposes

- Student does not live with parent(s)

- Student demonstrates total self-sufficiency