During the COVID-19 emergency, the U.S. Government implemented measures to assist students by pausing Federal Student Loan payments and setting the interest rate at 0%. Unfortunately, these benefits will come to an end on Friday - September 1, 2023.

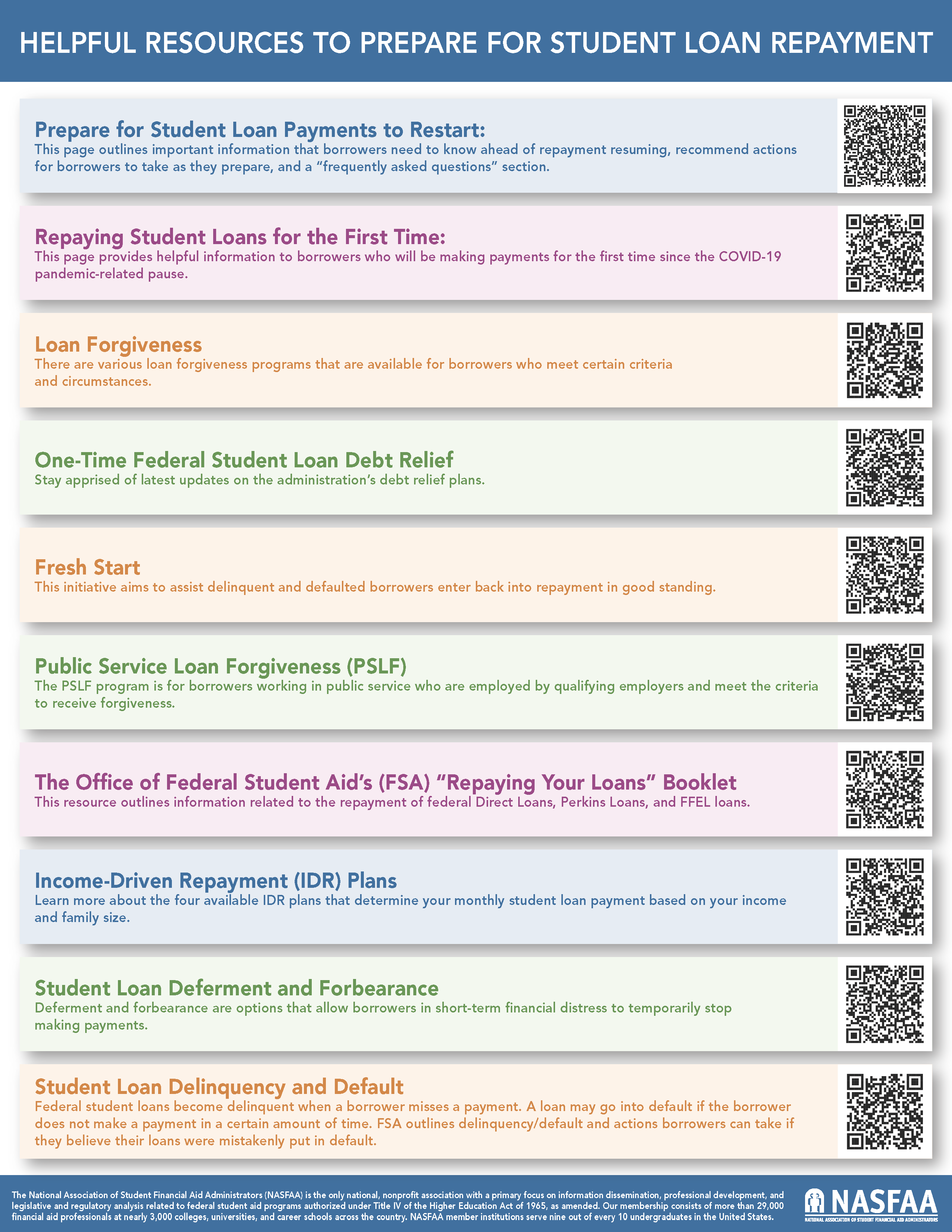

To help students navigate this transition effectively, the U.S. Department of Education (DOE) has provided a range of options and tools. We strongly encourage students to request changes that can assist them in managing their Loans once the payment pause ends on that date. It is important to emphasize that if their circumstances change, they will have the flexibility to make a different choice later.

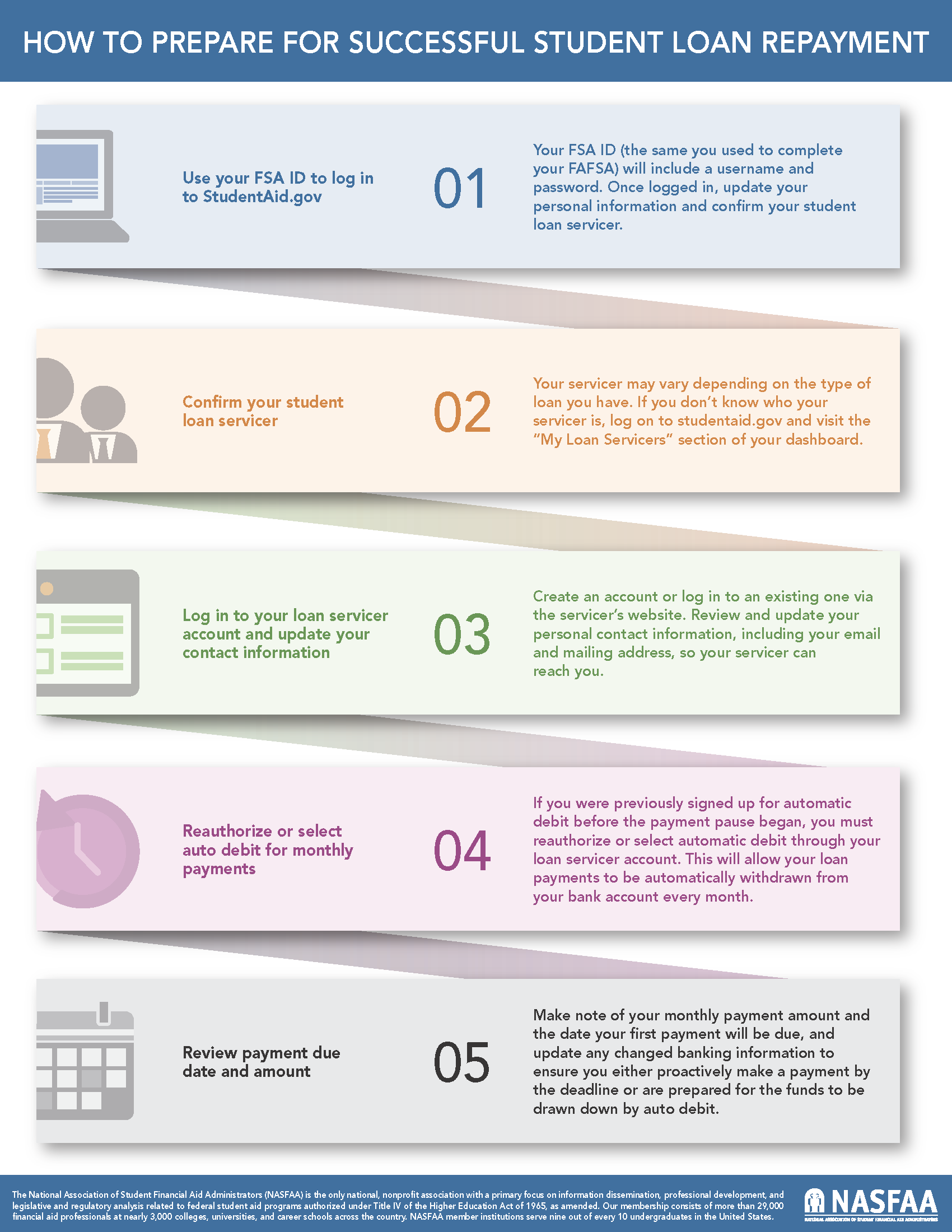

Preparing For Loan Repayments

Students should promptly update their contact information with their loan servicer and on studentaid.gov. This will ensure they receive all the necessary communications and avoid missing any crucial updates.

Students should evaluate their repayment plan options. If they anticipate needing a lower payment, they can visit Federal Student Aid's (FSA) Loan simulator to explore repayment plans that align with their needs and goals. Additionally, they may consider loan consolidation after carefully weighing the pros and cons.

Students facing financial challenges should explore Income-Driven Repayment (IDR) plans. These plans can potentially lower their monthly payments to as low as $0, depending on their circumstances. New this year is the Saving on a Valuable Education (SAVE) IDR plan, which will provide student loan borrowers with the most affordable repayment plan yet. The SAVE plan will cut payments on Undergraduate Loans in half compared to other IDR plans and protect more of a borrower’s income for basic needs.

Students should review their auto-debit enrollment status or consider signing up for auto-debit. By enrolling in auto-debit, Direct Loan borrowers can receive a 0.25% interest rate deduction on their loans.