Like all other CSU campuses, we are required by Federal and State regulations to ensure that each student receiving financial aid maintains Satisfactory Academic Progress (SAP) toward their degree objective. What makes a student academically eligible to be admitted and enroll in units at SF State is different from what makes a student academically eligible to receive financial aid.

If you are required to submit the form to our office, please click on the link listed right below to access the form.

| Standard | Details |

|---|---|

|

Satisfactorily complete a minimum percentage of their cumulative units |

|

Complete a degree program within 150% of the units for the degree |

|

Meet the minimum cumulative GPA of: 2.0 for Undergraduate students 3.0 or above for Graduate students |

Content Breakdown

SAP Standard Criteria

ALL students receiving Federal or State financial aid need to complete 67% of the units attempted.

This is a quantitative measure that calculates the pace or pass rate at which a student is progressing toward completion of his or her graduation requirements at SF State.

To be eligible for financial aid, a student must maintain a minimum pass rate. The pass rate is cumulative and is calculated every semester.

How We Define the Pace Standard:

- Completed units are defined as having earned a grade of A, B, C, D, or CR.

- Transfer units used toward your cumulative GPA are included in this calculation.

- Repeated units at SF State are also included.

- All types of attempted units are defined as such, regardless of the reason for the grade earned. Therefore, grades such as F, I, NC, U, W, AUD, RD, or SP count as units attempted with zero units earned.

How To Calculate the Pace (Pass Rate) Standard:

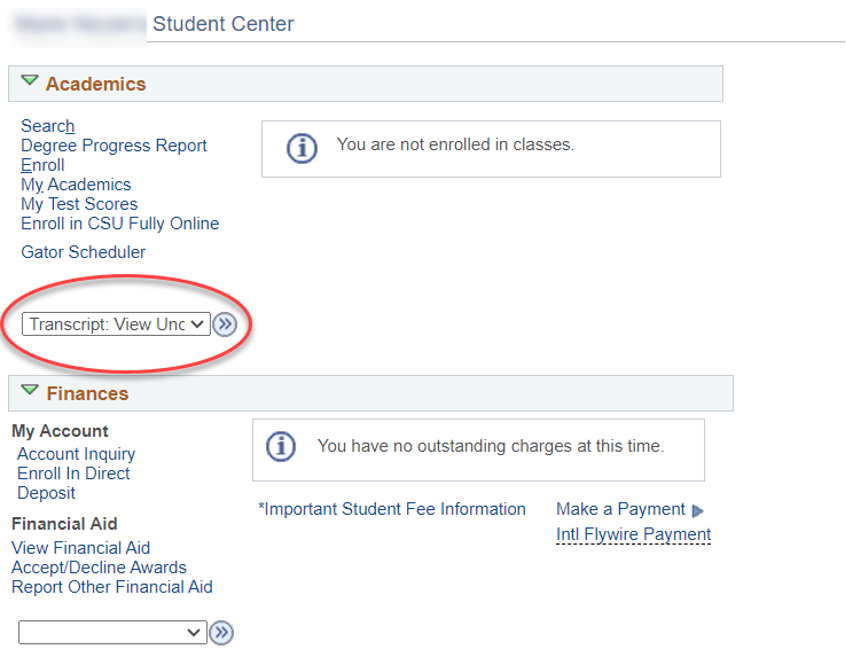

1.) Refer to your unofficial SF State transcript that can be accessed via the Student Center by selecting the drop down menu in the upper left.

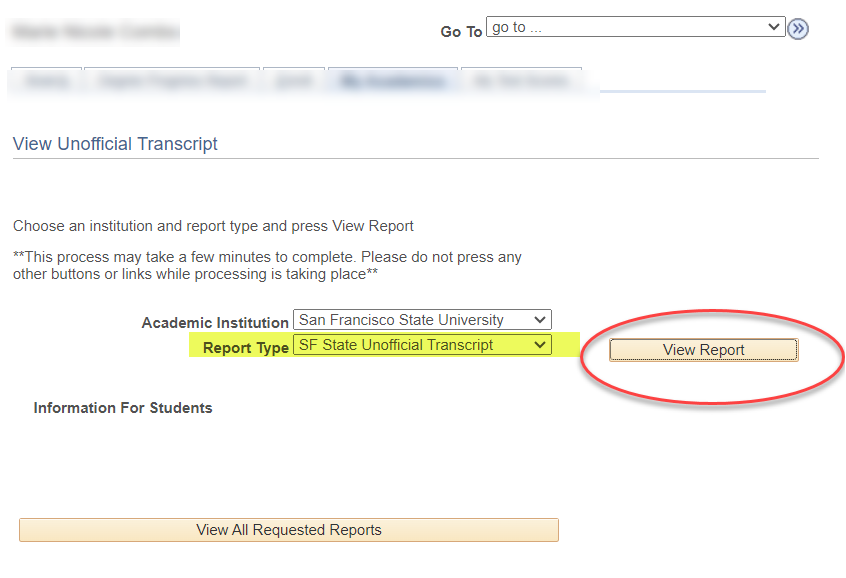

2.) Find in the “Report Type” dropdown menu,

3.) Select “SF State Unofficial Transcript” and

4.) Click the “View Report” button

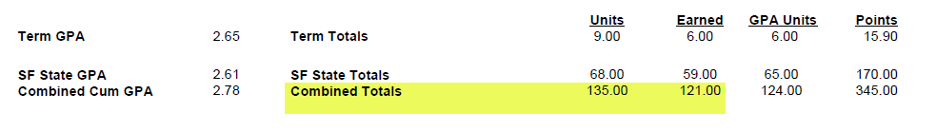

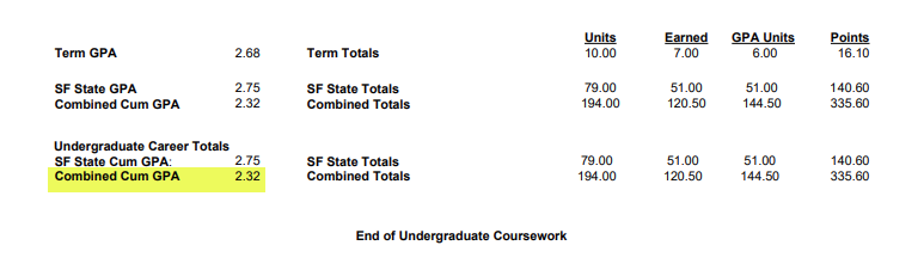

5.) Refer to the Combined Totals listed under the most recently completed semester

6.) In the example above, the attempted cumulative units are 135 and the cumulative completed units are 121, a Pace of 89.6% which meets the 67% standard.

To meet the standard, ALL students must complete their program of study within 150% of the units required for the degree.

This requirement is to ensure a student is completing the academic program within a reasonable overall time frame based on units attempted.

Like the Pace standard, transfer units from other institutions used toward your cumulative GPA are included - Regardless of whether or not SF State has accepted the units toward the degree OR whether or not financial aid was received for those units.

All units attempted at SF State are also included.

| Maximum time frame: | 150% units required to complete programs |

|---|---|

| Undergraduate students | 180 Attempted units |

| Master's degree candidates | Varies by major |

| Teaching credential candidates | 57 units |

| Second baccalaureate students | 75 units |

| Certificate students | Varies by program |

| Doctoral degree candidates | 75 units |

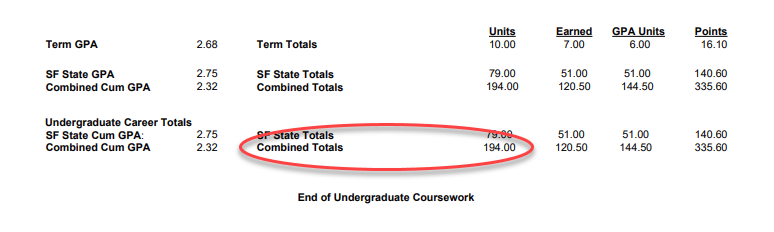

Cumulative attempted units can be found listed at the bottom of your unofficial transcript.

Students are ineligible to receive financial aid if they are dismissed academically from the University.

Financial aid recipients must be in good academic standing with the University. The Office of Student Financial Aid will adhere to the University's academic standard requiring:

- 2.0 minimum GPA for Undergraduate students

- 3.0 or above for Graduate students.

Please refer to the University Bulletin for more information.

How we monitor SAP

- SAP is monitored every semester. The warning and/or appeal probationary period, therefore, is the equivalent to one semester where at least half time units are attempted.

- Students who fully meet all three standards above are considered successfully making academic progress for financial aid.

- Students who are not meeting one or more standards are notified via their SF State email of the results and the impact on their aid eligibility. Students first receive a "Warning" status for one semester. If after the Warning semester they are still not meeting SAP, you will be considered Failing SAP, and will need to submit an appeal to regain your eligibility.

Appeals Policy

Students who are not meeting SAP for financial aid may submit an appeal to regain eligibility for one semester of financial aid probation. Appeals are reviewed on a case-by-case basis by the SAP coordinator and/or designated Financial Aid counselor.

The appeal must include the following items as list right below:

This should explain the extenuating circumstances* that affected your ability to make progress toward completing graduation requirements at an acceptable rate and what has changed so that you will meet SAP standards in the future.

As defined by Federal guidelines, examples of extenuating circumstances include:

- Prolonged illness under a doctor's care or illness/accidents requiring hospitalization

- Prolonged illness of a dependent

- Death of an immediate family member

- Interpersonal problems relating to family, financial, or scholastic issues

- Financial Difficulties

- Change in major (Only for those not meeting Max Time Frame)

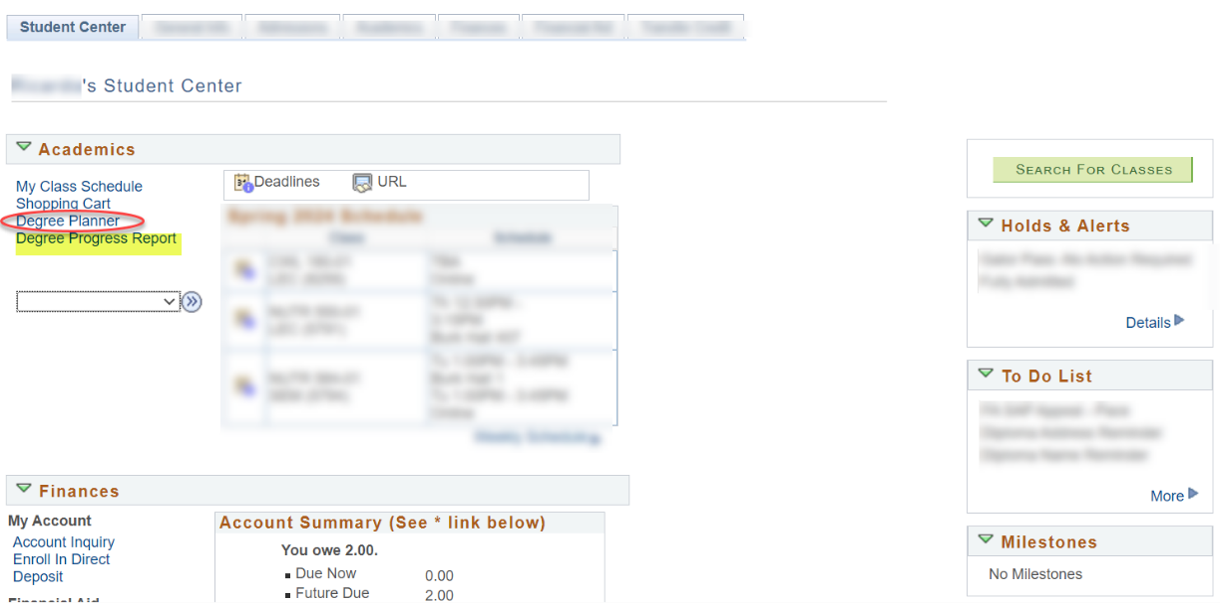

List of remaining courses that should be completed with the help of an academic advisor and/or your major advisor. Among ways to obtain an education plan for Undergraduate students include visiting the Student Center online and selecting “Degree Planner” on the upper left (Circled in red):

For Graduate Students - The Degree Progress Report (Highlighted in yellow) can be used or the completed Advancement to Candidacy form (If available).

Frequently Asked Questions (FAQs) about SAP

Review Timeframe - 2 to 3 weeks after appeal submission

Students will automatically be notified by via their SF Stat e-mail of the appeal decision in approximately 2 to 3 weeks from the date the appeal was received in our system.

If a student's appeal is approved, they should know:

- A student who has successfully appealed will have a probationary period of one semester to meet Satisfactory Academic Progress Standards. By the end of the probationary period, they must be meeting the standards to retain their financial aid eligibility.

- If they are not meeting the Maximum Time Frame standard, they will have until the end of the semester for which they appeal to finish their program while retaining financial aid eligibility. After the probationary period ends, they will no longer be eligible for financial aid at SF State.

In some cases, students may still not be meeting SAP after the term for which they appeal and need to submit an appeal again to regain eligibility. Students may submit another appeal if:

- The extenuating circumstances are different than the previous appeal

- Supporting documentation is provided (Ex. For a medical issue, a doctor's note, etc.)

Students who submit a subsequent appeal after having appealed previously will have their appeal documentation reviewed by a three-person committee. Students will be notified of the committee’s decision within 2-3 weeks.